TL;DR

The US elections are finally behind us, and to the relief of investors, we got a VERY CLEAR winner. Beyond anything political, I think the biggest risk was always the uncertainty that a close election could cause.

But markets exploded higher as it became clear that Trump would once again be president. Of course, not all stocks reacted the same, with some “Trump stocks” showing double-digit gains in a matter of hours.

In this post, I cover 5 Trump stocks you may want to keep an eye on.

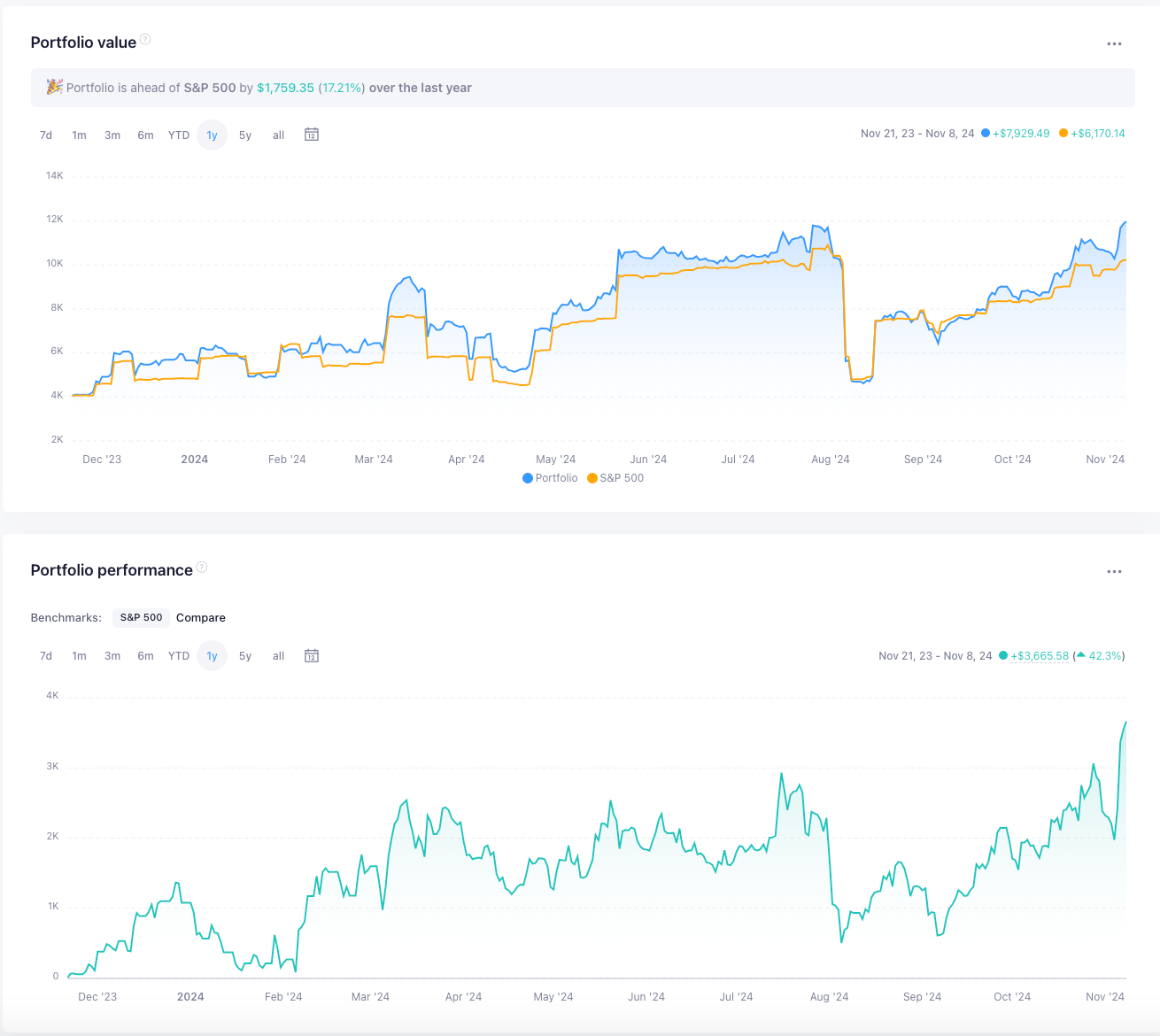

Lastly, we review our Swing Portfolio, which is now up 35%. We managed to pick up some stocks after earnings which have done very well in this rally, and we are also “lucky” enough to have some exposure to Trump stocks.

TSLA

Needless to say, Elon Musk and TSLA are big winners from the election. The stock is already up a good 20% since Trump’s win, and this has room to grow.

Tesla is perhaps one of the stocks I have covered the most on Seeking Alpha. I have been a LT bull, although it’s been hard to stay long with such bearish sentiment and, to be fair, the company has also struggled to deliver on investors’ lofty expectations.

Does this all change with Trump? It’s not like anything will change instantly, but we will likely see some benefits to TSLA over the coming years such as:

Regulations and tariffs on foreign EVs

More subsidies for American produced cars

Possible US grants for AI technology

Say what you will about Musk, but somehow he always manages to be on the right side of the government.

Running a fib extension, the 1,618 level gets us towards at least $400, an easy 30% gain from here, so not too late to buy.

Of course, we’ve owned this stock in the Swing Portfolio since around $182.

GEO

So, while I am suggesting you might want to chase Tesla, this one here is an example of a stock I would not necessarily chase.

GEO Group is a company that runs Federal prisons and there’s an idea that it will benefit from Trump’s stricter enforcement of immigration laws.

Well, as we can see above, the stock did initially rally back in 2016 as Trump became president, but this was short-lived.

Revenues, which we can see in the last pane did increase into 2019, but the stock actually fell during this time.

If history repeats, then most of the juice might have already been squeezed. We’re running into some serious resistance, and I think this will consolidate at this price. I may be wrong, but I’d need to see some concrete change in revenues to consider chasing this.

INTC

This could be a big winner from the Trump presidency, no doubt, and arguably a buy for many other reasons.

In case you’ve been living under a rock with no internet connection, a little refresher in Intel.

This stock has been absolutely hammered over the last year. The company has been losing market share to its competitors, it is not benefitting from AI, and now it is making a huge though somewhat questionable investment into becoming a Foundry.

In other words, Intel is looking to actually physically make chips rather than just design them.

With most chips coming from Taiwan’s TSM, this has become a national defense issue, which is why the company has secured billions in aid through the CHIPS Act.

Well, if Trump keeps delivering on his rhetoric, then it’s likely that Intel will continue to receive help from the government, and that companies will have some strong incentives to use Intel’s foundry rather than TSM.

The stock has been rallying since its recent low and it looks like it is trying to build an impulse. We have some room to keep rallying until we find resistance at $30.

DJT

No analysis of Trump stocks would be complete without a look at DJT. This is the “company” that owns Truth Social. Yes, some good money has been made running up to the election, but unsurprisingly this has been in free-fall ever since.

Like with GEO, I don’t advise chasing this. There’s not much there fundamentally. You could go long around $24 for another Swing higher and you might get lucky, but I’m not going to speculate to that degree.

COIN

Last, but certainly not least, let’s talk about COIN.

It is well known that Trump=Crypto to the moon, We’ve seen this in full swing already. Bitcoin made new highs, miners jumped double digits and altcoins too caught a big bid.

This rally might be a bit overdone, but it certainly has legs. I think one of the most undervalued stocks in this space is COIN.

This actually sold off ahead of the election following its earnings. It’s been struggling to capitalize on the Bitcoin hype so far, but there’s no doubt in my mind that this can run much higher in the next two quarters if Bitcoin reaches $100K as I expect.

We were lucky enough to buy some stocks on the dip after earnings, as I wanted subscribers.

With that said, it’s now time to review our swing portfolio.

In the next section, we will cover:

A Nuclear Stock That Will Benefit From Trump's Presidency

A Fantastic Dip-Buying Opportunity On A Stock Down 15% After Earnings

My Favourite Chip Stocks Hitting Multi-Year Support

Swing Portfolio Update

Ahead of the open today, the Swing Portfolio is up 35.6% since inception, outperforming the S&P 500 by a margin.

Let’s now update the holdings and talk about some of the new trades we are planning.

We already covered COIN and TSLA above.

Keep reading with a 7-day free trial

Subscribe to The Pragmatic Investor to keep reading this post and get 7 days of free access to the full post archives.