Thesis Summary

Amazon AMZN 0.00%↑ reported Q2 earnings, and the stock has sold off over 15% since its recent peak.

In my opinion, this is a phenomenal buying opportunity for anyone looking to buy and hold this stock for the next few decades.

Amazon continues to grow at a fast pace, has diversified revenue streams, a moat and is a cash printing machine.

There are few companies I would confidently buy and hold for the next 100 years, but AMZN is one of them.

Expect to learn:

Why Amazon's Recent Sell-Off May Be a Buying Opportunity. Uncover the reasons behind Amazon's 15% stock drop and why it could be an ideal time to invest.

How AWS and E-Commerce Drive Amazon's Growth: Understand how Amazon's dominance in cloud infrastructure and e-commerce is fueling its long-term success.

The Power of Amazon's Diverse Revenue Streams: Discover how Amazon's wide-ranging revenue sources, including AWS, advertising, and subscription services, are key to its future growth.

Why Amazon's Valuation Is Attractive Right Now: Learn why Amazon is trading at historically low valuations and why it could be a great investment.

Key Technical and Fundamental Indicators to Watch: Explore the technical signals and financial fundamentals that suggest Amazon may be on the brink of a recovery.

Q2 Earnings

Overall, I believe the company delivered a solid quarter, despite some unevenness in the Q2 results.

AMZN reported earnings of $1.26 per share, nearly doubling the $0.65 from the previous year and surpassing market expectations. Revenue reached $148B, falling just short of market consensus by $760M. Notably, AWS saw an 18.7% YOY growth, reaching $26.3B, surpassing Wall Street's guidance of +17.6%, as illustrated in the chart below.

Consolidated revenue grew by 10% year-over-year, with all three segments showing positive growth—an encouraging sign for any business. Amazon Web Services (AWS), the company's fastest-growing and most profitable division, along with the North America e-commerce segment, were the primary drivers of revenue growth in Q2.

Now let’s see how each of the other Amazon segments did.

The standout performer in the quarter was Amazon's ad business, which grew by 22%. Recently, Amazon has begun incorporating limited ads into Prime Video to better monetize its significant investments in media and film production. It appears that there is a growing trend of ad dollars moving closer to the point of sale, leading to an increase in the number of ads on Amazon's platform where consumers make purchasing decisions.

The above table highlights that AWS revenue growth accelerated in Q2, a highly favourable trend. Notably, AWS has shown consistent sequential revenue growth for five consecutive quarters, indicating stability without seasonal fluctuations. The slide below illustrates that AWS's operating income is outpacing its revenue growth, demonstrating strong operating leverage and suggesting that profitability could continue to improve as revenue increases.

Overall, not a bad quarter, anda totally unwarranted sell-off in the stock.

Why I Really Like Amazon

Amazon is in my opinion one of the highest conviction stocks one can own for the long-term. If I were to bet on a company still being around in 100 years, it would be Amazon, or perhaps Google.

Amazon possess all the key ingredients that make it an End Of The World stock

Moat

Diversified Revenues

Balance Sheet

Long-term secular growth

Profitability and cash flow

Moat

In terms of the Moat, I will talk about e-commerce and AWS.

I believe Amazon's dominance in e-commerce is unassailable, as the business functions like a snowball—growing larger and more powerful as it scales, making it easier to attract new merchants and customers. Amazon consistently pushes the envelope with innovations such as electric van and drone deliveries and its Amazon Prime subscription service. As the global e-commerce leader, (excluding Alibaba) Amazon also holds the top spot in major European markets.

Then we have AWS, which is also a market leader:

AWS continues to dominate the global cloud infrastructure market, holding a 32% market share in Q2 2024, with Microsoft and Google trailing behind at 23% and 12%, respectively.

Amazon's leadership in this space is the result of years of aggressive investment in growth, including approximately $400 billion in R&D over the past decade.

While Amazon doesn't break down its R&D spending by segments, it's likely that a significant portion was directed toward AWS. Given Amazon's unwavering commitment to innovation and its robust balance sheet, I believe the company is well-positioned to sustain its leadership in the cloud industry for the foreseeable future.

Diversified Revenues

Needles to say, Amazon has developed robust and diversified form s of revenue.

While over 40% of its revenues still come from e-Commerce, this company is now doing much more. 24% of revenues come from Seller services.

The AWS and Adversting segments now account for over 20% of revenues, and then, we have subscription services, which now represent 7%.

Long-term secular growth

With the exception of Online stores, all the other segments are growing at double digits, and this is likely to continue, let’s look at some forecasts.

North American e-commerce is projected to grow at a 10.2% CAGR by 2032, Amazon is well-positioned to capitalize on these favorable industry trends as the undisputed leader.

The chart below illustrates Amazon's aggressive market share expansion, steadily closing the gap with industry giants Google and Meta (META), and is projected to narrow it considerably by 2026. Digital advertising is another rapidly growing sector where Amazon already has a strong presence. This industry is expected to grow at a 14% CAGR by 2030.

.

And of course, Cloud computing has perhaps the best long-term outlook. With a projected growth of 17.8% CAGR by 2032.

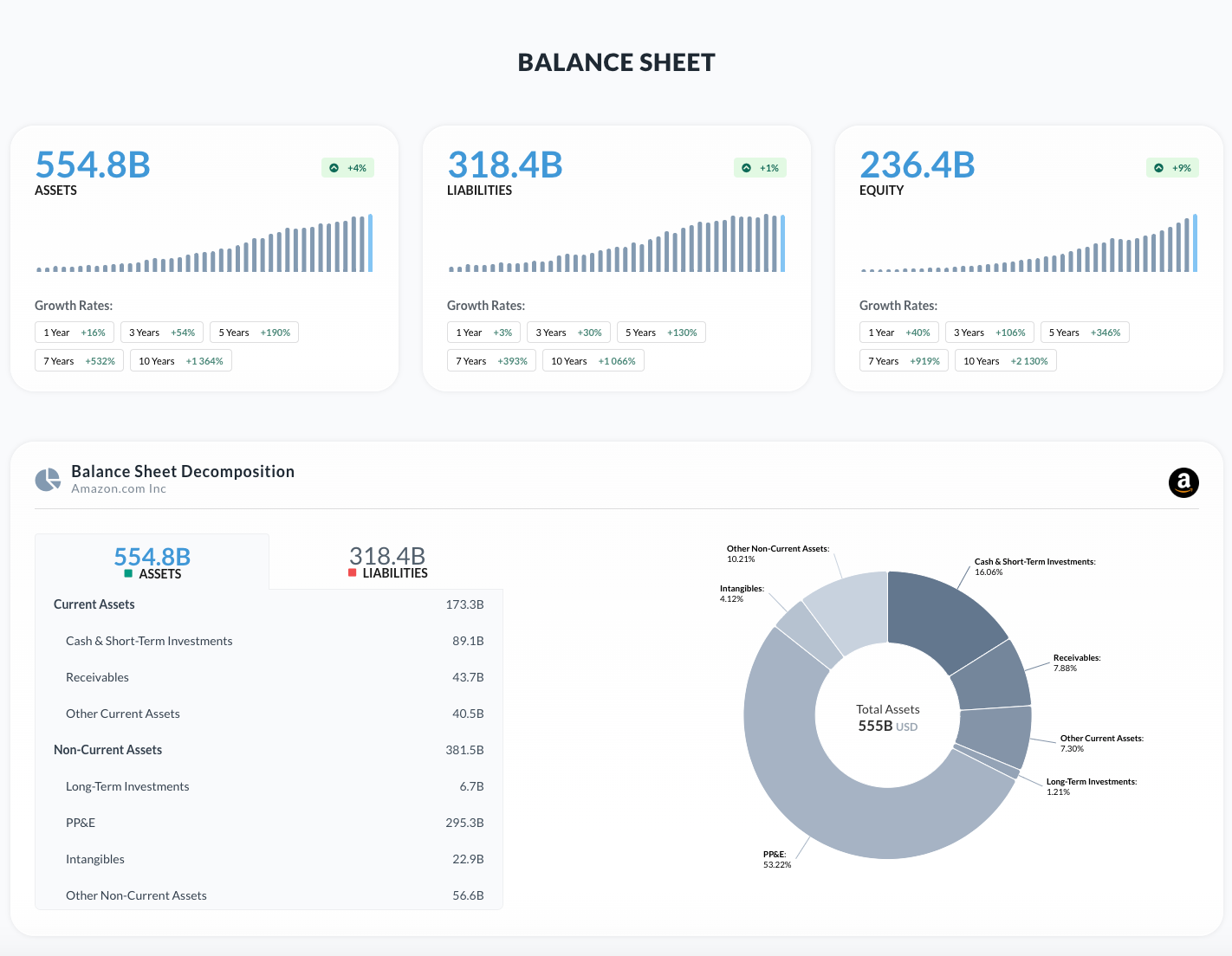

Balance Sheet

Amazon has one of the strongest balance sheets in the S&P 500.

Alphasperad gives Amzb a solvency score of 80.

The company has assets well above liabilities and almost $90 billion in cash and short-term investments.

Profitability and cash flow

Amazon has become a cash making machine over the past 5 years. This is clear if we look at the company’s margins.

Operating margins have climbed to over 8% and will continue to expand as the company makes more income from its higher margin businesses and also optimizes its operations even further through scale and improved technology.

The growth in cash flow is simply staggering.

Valuation

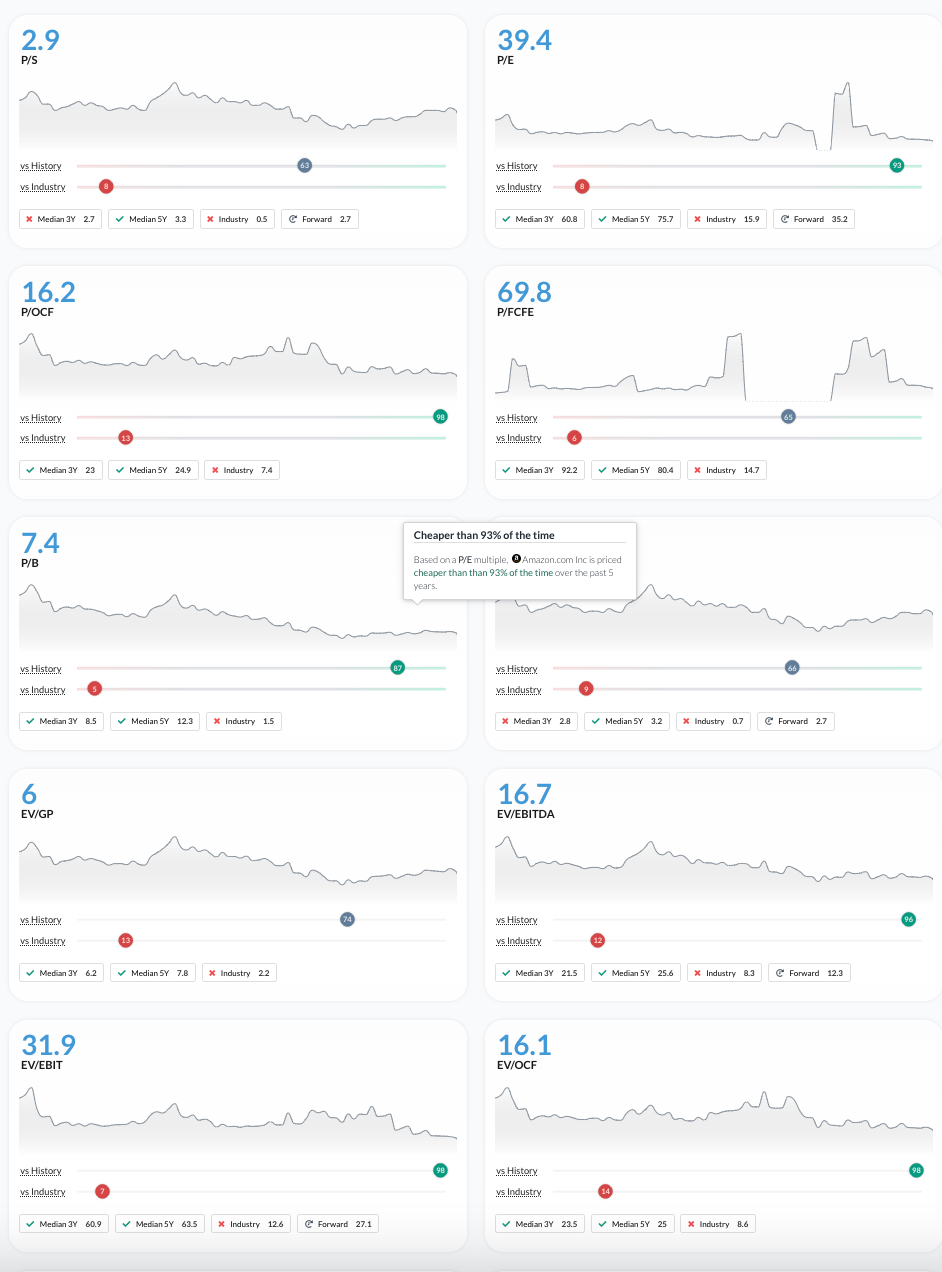

With the latest sell-off, and in the face of improving earnings, Amazon is by most metrics as cheap as it has ever been.

And we can see, in terms of its history, Amazon is cheaper than now that around 90% of the time in terms of metrics like PE and EV/EBITDA.

With a PEG of 0.17 and a forward PEG of 1.51, this is very reasonably priced when compared with the industry, and more so if we compare it to the other mega-cap tech stocks.

Technical Analysis

The latest sell-off saw us go below the 200 EMA, while the daily RSI entered oversold conditions. We actually began to reverse at the 38.2% retracement of the wally from the October lows.

While we may encounter resistance now at the 50 EMA, it looks like a bottom could have been struck.

Even if this wasn't’ the bottom, I’d be very surprised if we went below the 200 weekly EMA at $139. At that price Amazon would be an absolute bargain.

Takeaway

In conclusion, Amazon's recent stock sell-off presents a compelling buying opportunity for long-term investors. The company continues to demonstrate robust growth across its diverse revenue streams, including AWS and advertising, while maintaining a strong balance sheet and expanding its profitability and cash flow.

Amazon's unassailable moat in e-commerce and cloud infrastructure, coupled with its commitment to innovation and market leadership, makes it one of the most resilient and promising investments for the future. With the stock trading at historically low valuations, this is an ideal moment to consider adding Amazon to your portfolio.

Not a member yet? Please consider joining us today at a 30% discount!

This will give you:

Portfolio Access

Full posts

Members only live stream

Char privileges

Isnt this the case with MSFT as well?

There may be a play to be had here