Summary

Markets are bearish, but contrarian indicators suggest a potential turnaround.

Earnings season has begun, with the market punishing earnings beats.

Only Bitcoin has escaped the bloodshed.

The Week That Was

Markets took a step back last week, and though we are near the levels seen a couple of weeks ago, the bearishness seems to be reaching a fever pitch.

Without a doubt, this is a decent contrarian indicator, much like the Buy Signal issued by BofA’s Bull & Bear Indicator.

In terms of macro data, initial jobless claims continued to trend down in the US.

Over in Japan, I believe we got a very bullish inflation print, as Core PCE fell below 3% for the first time in over a year:

This is great news for markets, as it could take the pressure off the BoJ to keep raising rates, which, as I’ve explained before, would unwind the Yen Carry trade.

Punishing Earnings

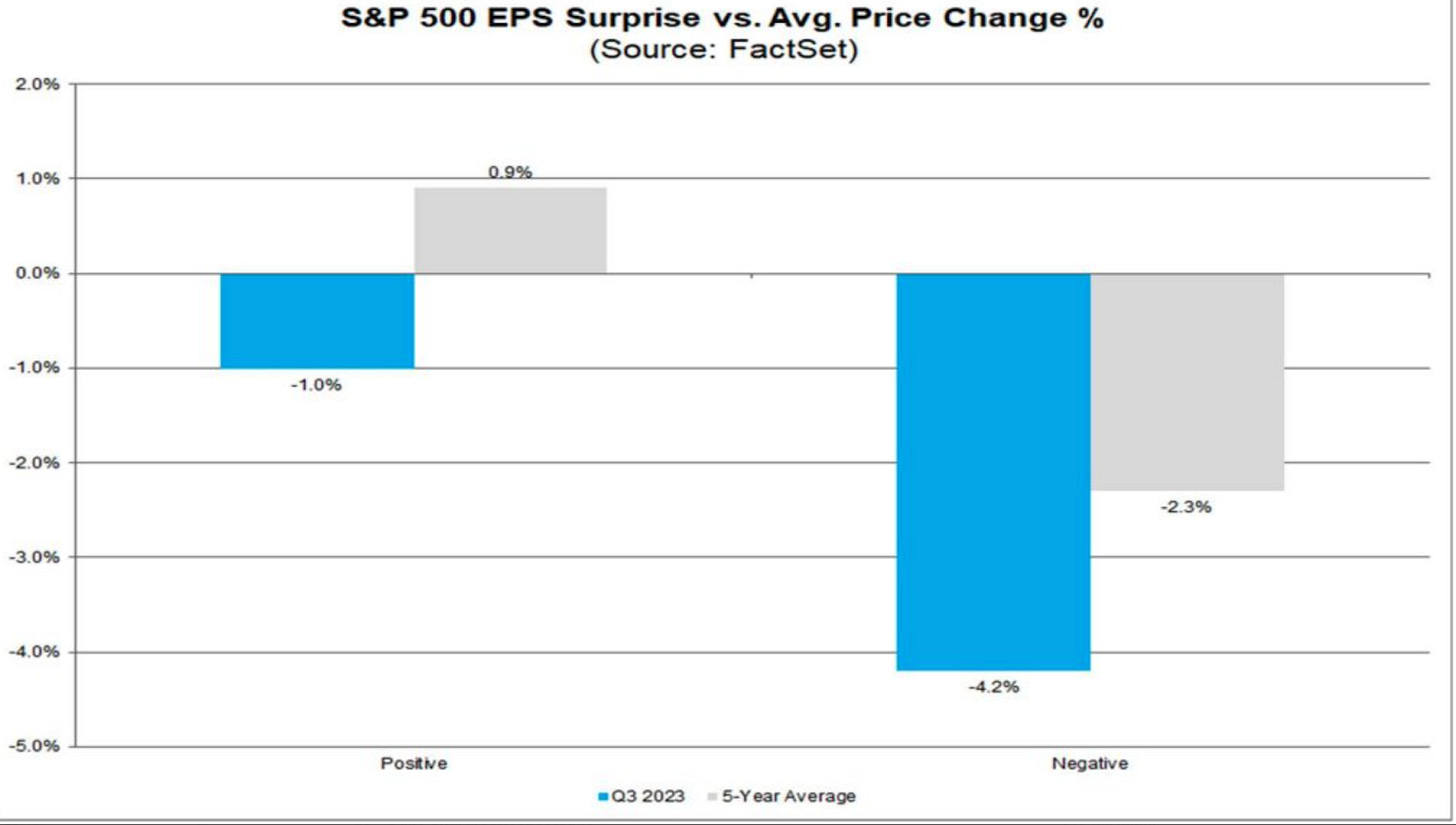

While rising yields seem to be taking centre stage, earnings season has begun, and we are observing an interesting dynamic.

The market is punishing earnings beats. It seems like markets don’t care about actual earnings, and we are seeing an interesting “divergence”.

Stocks are trading at historically low PEs, especially when you look at something like the S&P 600. Even the S&P 500 is trading at quite a “reasonable” forward P/E ratio.

Most analysts seem to be expecting decent earnings growth in the coming quarters, but it looks like the macro outlook is weighing down on these.

Market Update

The SPX is seeking to make another low today, as we break below the 200 day MA.

This should be a wave v completion, which could find support around the 4100 area.

Meanwhile, Yields keep ticking higher but are showing signs of divergence:

All sectors red in the last month, except for Energy and Consumer services:

Chart Of The Week

Of course, there is one asset class that has escaped the bloodshed (so far?)

I would say we can officially count an impulse from the recent lows. With the RSI now very overbought on the daily, we should expect a pull-back into the 27K level. This would be an ideal place to add in terms of R/R.

What Comes Next?

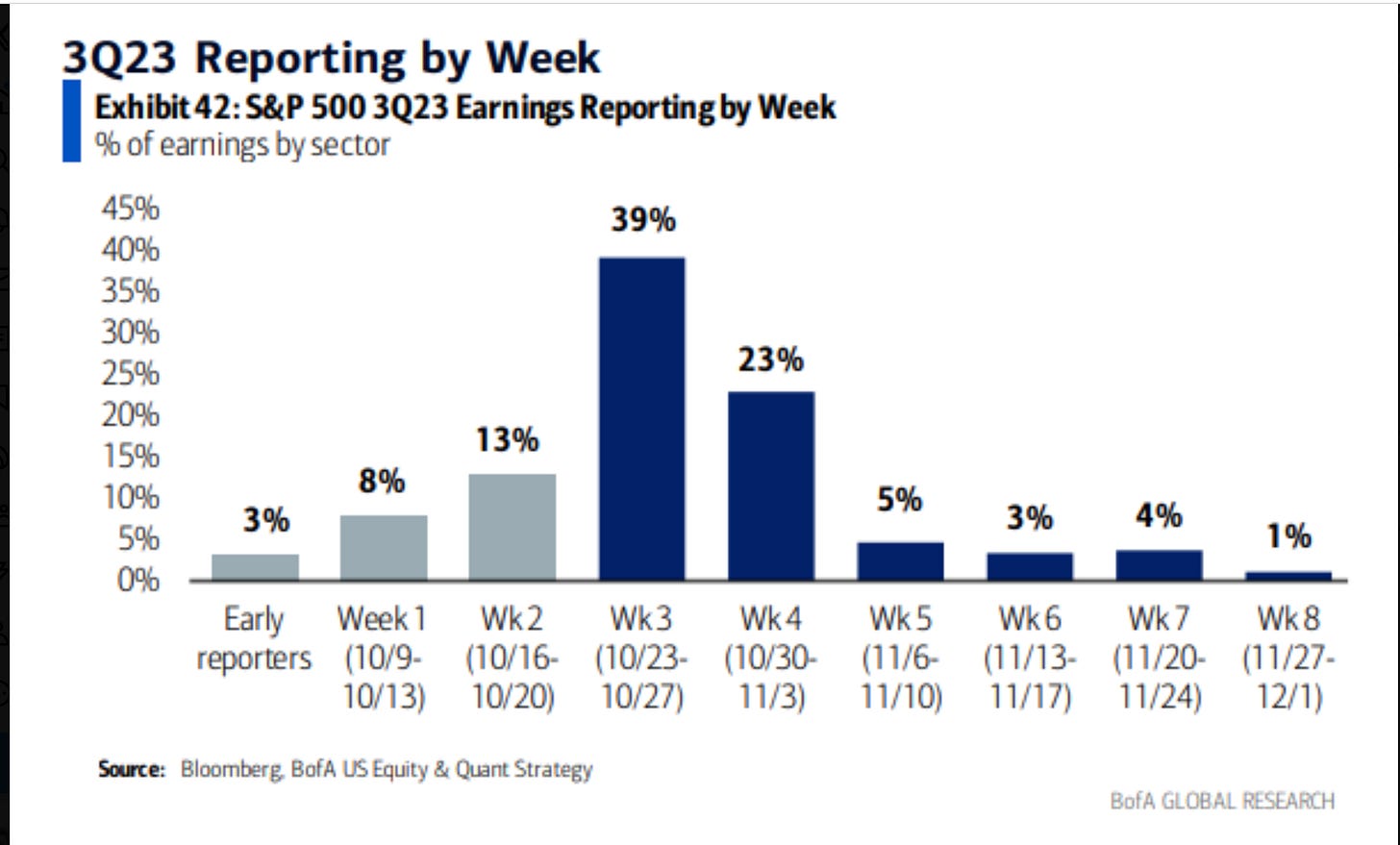

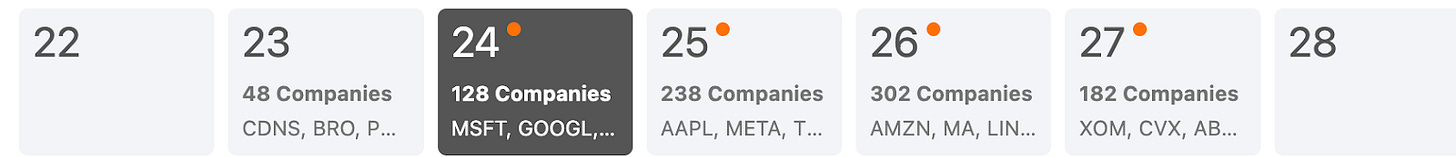

No big deal, but we have 39% of the S&P earnings reporting this week:

Miscrosoft and Google on Tuesday

Apple and Meta on wednesday

Amazon on Friday

And in terms of macro data, we have manufacturing data on Tuesday:

And initial jobless claims on Thursday:

Final Thoughts

This will be a massive week for stocks, as we will, in my opinion, either set a bottom for a year-end rally or confirm a much larger breakdown. Plenty of opportunities will arise, so stay tuned for coming updates.