Elon Musk Should Also Buy $RDDT; Price Will 3x From Here

Adding this to my YOLO portfolio

Thesis Summary

Reddit (RDDT) IPO’d less than a year ago, and the stock just popped 40% after delivering great earnings in Q3.

This stock is firing on all cylinders, showing growth in revenues and margin expansion, and with plenty of juice left to squeeze.

In the article below, I discuss:

Reddit’s business model

Why I really like the stock

Valuation and PT

Risks

Conclusion

Business Overview

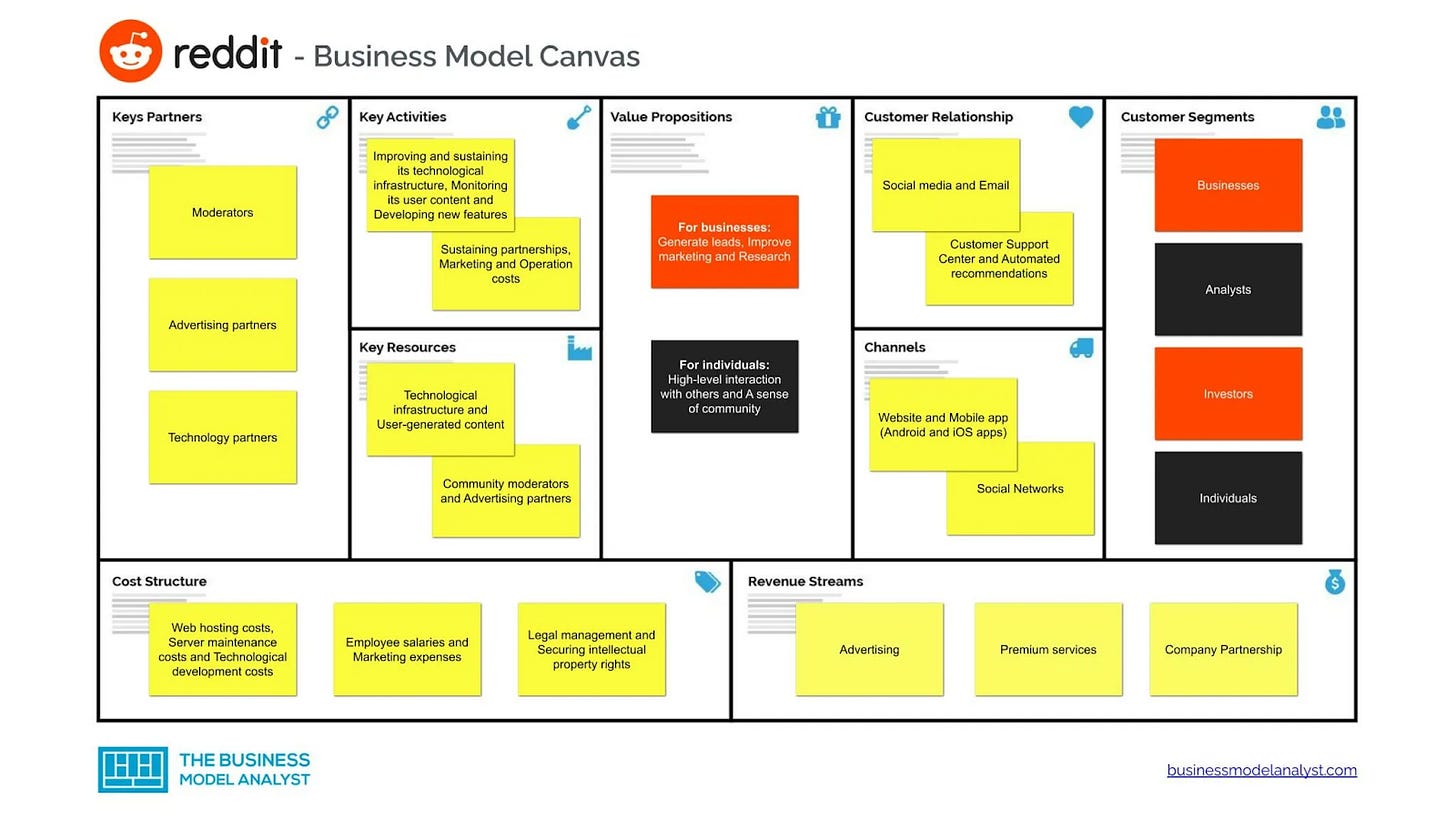

Reddit’s business model combines ad sales, promoted content, and premium subscriptions, with revenue coming from ads, sponsored posts, and Reddit Premium, which offers perks like ad-free browsing. As one of the largest discussion networks, Reddit, founded in 2005, is a platform for users (Redditors) to post and engage on various topics within “subreddits.” Covering interests from technology and entertainment to niche communities, these subreddits create spaces for diverse discussions across topics.

Reddit's revenue model is based on three main streams: advertising, premium memberships, and partnerships. Through targeted advertising, Reddit allows advertisers to reach niche communities with either managed or self-serve ad options.

Its premium memberships, known as Reddit Gold, offer ad-free browsing and customization options, generating recurring revenue. Additionally, partnerships with companies for sponsored content contribute significantly.

Reddit's ad revenue notably increased from $119 million in 2019 to about $261.7 million in 2021, while premium memberships grew steadily as a secondary revenue source.

Q3 Numbers

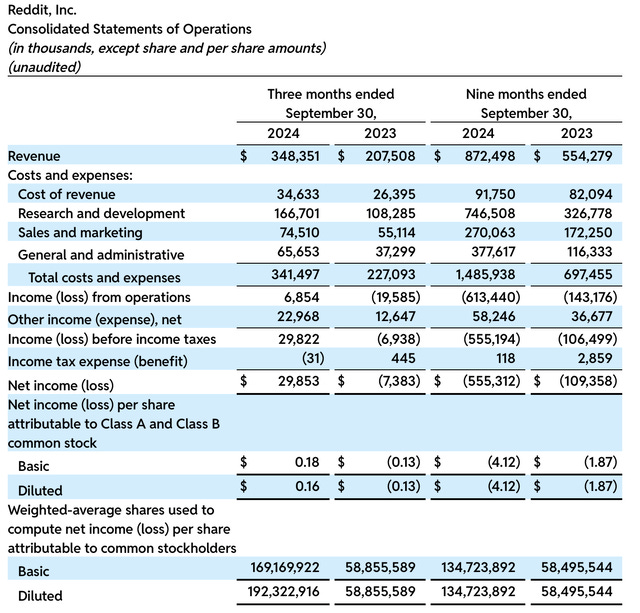

In Q3, Reddit saw a remarkable 68% year-over-year (y/y) revenue increase to $348.4 million, exceeding Wall Street’s $314.8 million forecast.

Profitability also strengthened, with adjusted EBITDA margins jumping over 30 percentage points y/y to 27%. Reddit achieved a GAAP-based EPS of $0.16, outperforming analysts’ projected -$0.06. This profitability places Reddit ahead of many high-growth tech peers and supports its continued investment in international markets.

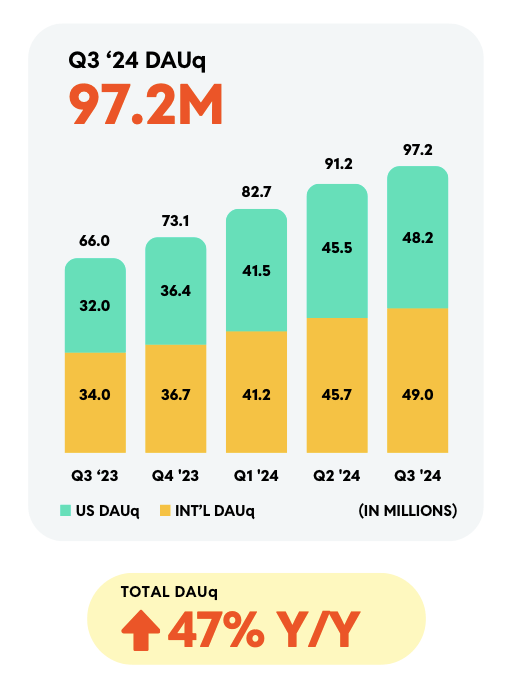

User growth was a key driver, with daily active users (DAUs) rising 47% y/y to 97.2 million.

International growth showed especially strong momentum, driven by Reddit’s machine translation rollout. The translation has already been implemented in French and Spanish and is expanding to more than 30 countries, including Germany and Brazil.

This strategy fueled 44% y/y growth in international DAUs and 57% y/y growth in international revenue. Reddit's machine learning advancements continue to enhance translation efficiency, keeping costs below 1% of total revenue.

While ad load and engagement helped increase average revenue per user (ARPU) by 14%, Reddit emphasized that ad pricing remained consistent with previous quarters. Higher ad density, although effective in the short term, has limitations, as user experience can suffer if ad volume rises too high—an approach previously taken by Meta that ultimately limited its growth rates.

Why I Like Reddit

Keep reading with a 7-day free trial

Subscribe to The Pragmatic Investor to keep reading this post and get 7 days of free access to the full post archives.