Consensus says Bitcoin is entering a multi-year winter, but the data suggests we’re closer to the end of the flush than the start of a new bear.

Bitcoin is down roughly 38% from its October highs.

Predictably, sentiment has flipped hard to the downside.

The dominant narrative is familiar: another prolonged crypto winter, years of sideways pain, and capital destruction ahead.

That view focuses almost entirely on price.

But here at the Pragmatic investor, we know cycles are driven by mechanics: risk transfer, positioning, relative valuation, liquidity, and who is actually buying during drawdowns. In those dimensions, this looks less like the start of a bear market and more like the final chapter of one.

Risk Has Already Been Transferred

Bitcoin cycles end when risk moves from weak hands to strong ones. Late 2025 showed a textbook version of this process.

Realised Cap data indicates that the share of coins held above roughly $95,000 fell sharply in a short period.

In plain terms, late-cycle buyers who chased six-figure headlines were forced out.

Those coins didn’t disappear; they changed hands, mostly to buyers with lower cost bases and longer time horizons.

This matters because markets bottom when sellers are exhausted, not when news turns positive. The current drawdown looks like a cleansing phase: speculative leverage and emotional capital flushed, replaced by holders who can tolerate volatility. That hardens the floor.

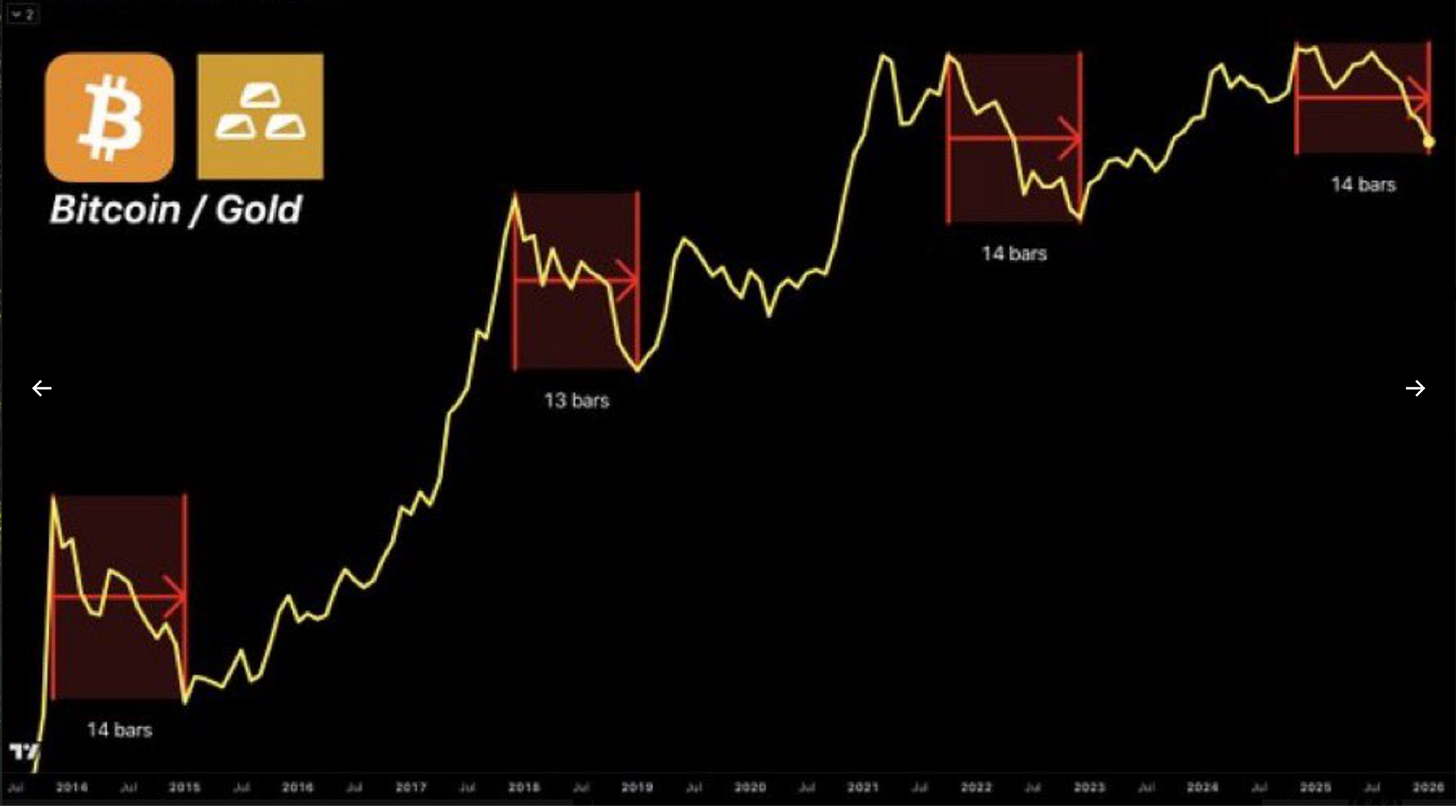

Bitcoin vs Gold Is Near a Regime Turn

Dollar price alone is a blunt tool. A cleaner signal comes from Bitcoin’s performance relative to gold.

Bitcoin has been in a relative bear market against gold since late 2024, lasting roughly 14 months.

Historically, these BTC/gold downtrends tend to run about 400 days. Prior cycles saw extreme drawdowns of 75–85%, but Bitcoin is a structurally more mature asset today, with deeper liquidity and broader ownership.

This cycle’s compression suggests a milder terminal move—closer to a 60–65% relative drawdown. We are now firmly inside the zone where previous cycles transitioned from underperformance to renewed leadership. That doesn’t guarantee an immediate rally, but it does argue the asymmetry is improving.

The Institutional Bid Hasn’t Broken

One of the cleanest tells in this cycle is what hasn’t happened: institutional demand has not disappeared.

U.S. spot Bitcoin ETFs continue to hold substantial net inflows on a cumulative basis. Corporate treasuries with explicit Bitcoin strategies are still adding through volatility. This is not reflexive retail momentum, it’s systematic allocation.

Institutional capital behaves differently from retail. It doesn’t panic sell because the price is down 30–40%. It rebalances, averages in, and waits. As long as that bid remains intact, the probability of a deep, prolonged bear market drops materially.

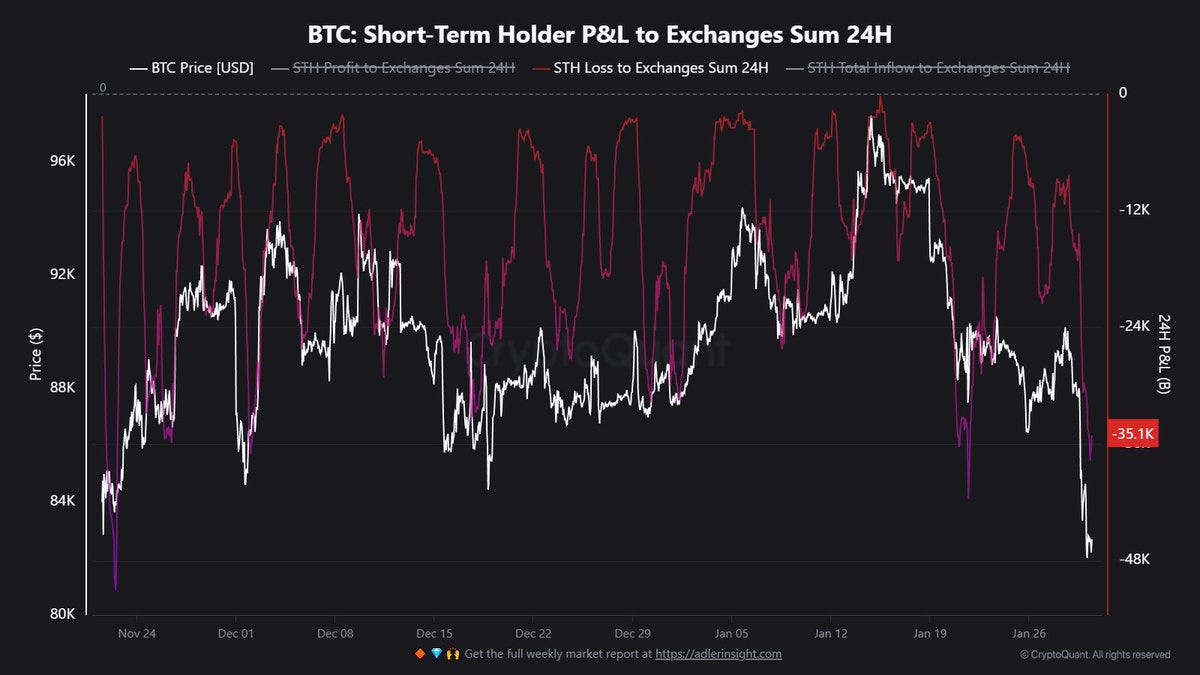

On-Chain Capitulation Looks Mature

On-chain metrics support the same conclusion. Short-term holder Net Unrealised Profit/Loss is deeply negative, signalling that recent buyers are under significant pressure.

Historically, this level of stress coincides with selling exhaustion, not the start of fresh downside. When the marginal seller has already sold, price doesn’t need good news to stabilize, only a lack of bad news.

This is the part of the cycle where volatility feels worst, but incremental downside becomes harder to sustain.

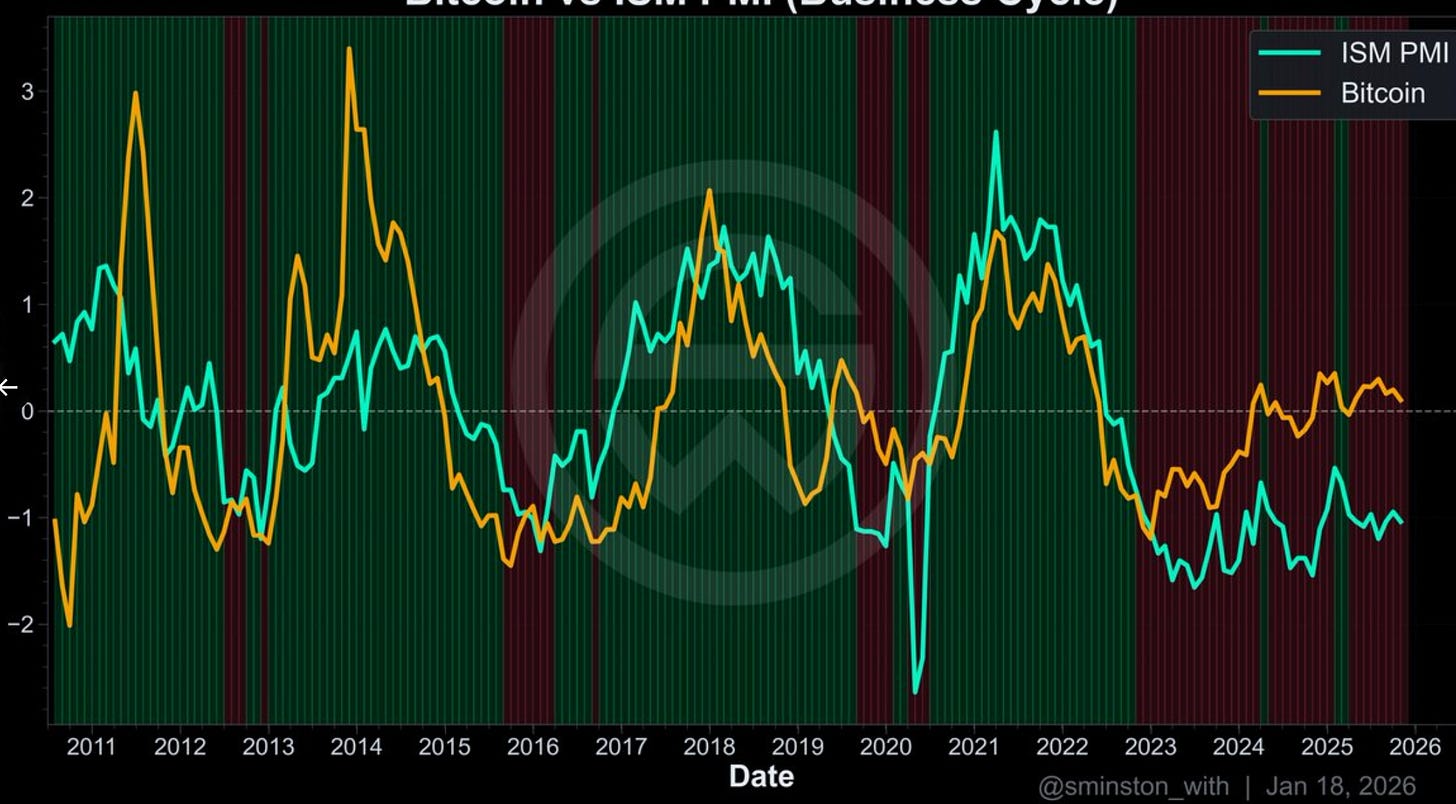

Macro Liquidity Is Turning Supportive

Finally, macro matters more than most crypto investors admit.

The latest ISM Manufacturing PMI reading moved decisively back into expansion territory after more than two years of contraction. Historically, sharp PMI rebounds from deep troughs tend to coincide with improving liquidity conditions.

Bitcoin doesn’t need rate cuts to rally; it needs liquidity expectations to stop deteriorating. Early-cycle macro expansion has often preceded Bitcoin’s strongest upside by roughly a year. We are now moving out of contraction and into that transition phase.

Bottom Line

The bearish narrative is emotionally compelling because it matches recent price action. The underlying mechanics tell a different story.

Risk has already been transferred. Relative valuation is compressed. Institutions are still buying. On-chain selling pressure looks exhausted. Macro liquidity is improving.

That doesn’t mean straight-line upside from here. It does mean the probability-weighted outcome favours consolidation and recovery over a fresh multi-year bear market.

Bitcoin has a long history of punishing consensus views at moments like this.

For pragmatic investors, this looks less like a time to capitulate and more like a time to stay rational while others can’t.