Thesis Summary

Hims and Hers (HIMS) is up a whopping 77% in the last month thanks to a renewed marker euphoria and blowout earnings.

This is undeniably a company that is executing strongly on its ambitious vision.

But is the stock overvalued here?

I’d like to take this chance to compare HIMS to another stock that a lot of investors think is overvalued: Palantir (PLTR).

Both of these stocks share some strong similarities, but I would contend that HIMS is cheaper and arguably a better buy than Palantir.

So while, by most traditional metrics HIMS seems overvalued, I’d argue that this stock could reach $100 within the next 12 months.

🚨 HIMS is the best performing stock in our YOLO portfolio, which is up 70% since inception.

High Conviction. High Velocity. YOLO Portfolio is where macro meets momentum. We take bold, calculated swings on asymmetric trades with explosive upside.

Join now and see what smart speculation really looks like.

HIMS Q1: Another Blowout

HIMS climbed over 20% following a blowout quarter, as the company continued to excel in growth and profitability.

The company achieved revenue of $586 million, up 111% YoY, with net income reaching $49.5 million and increasing 345%.

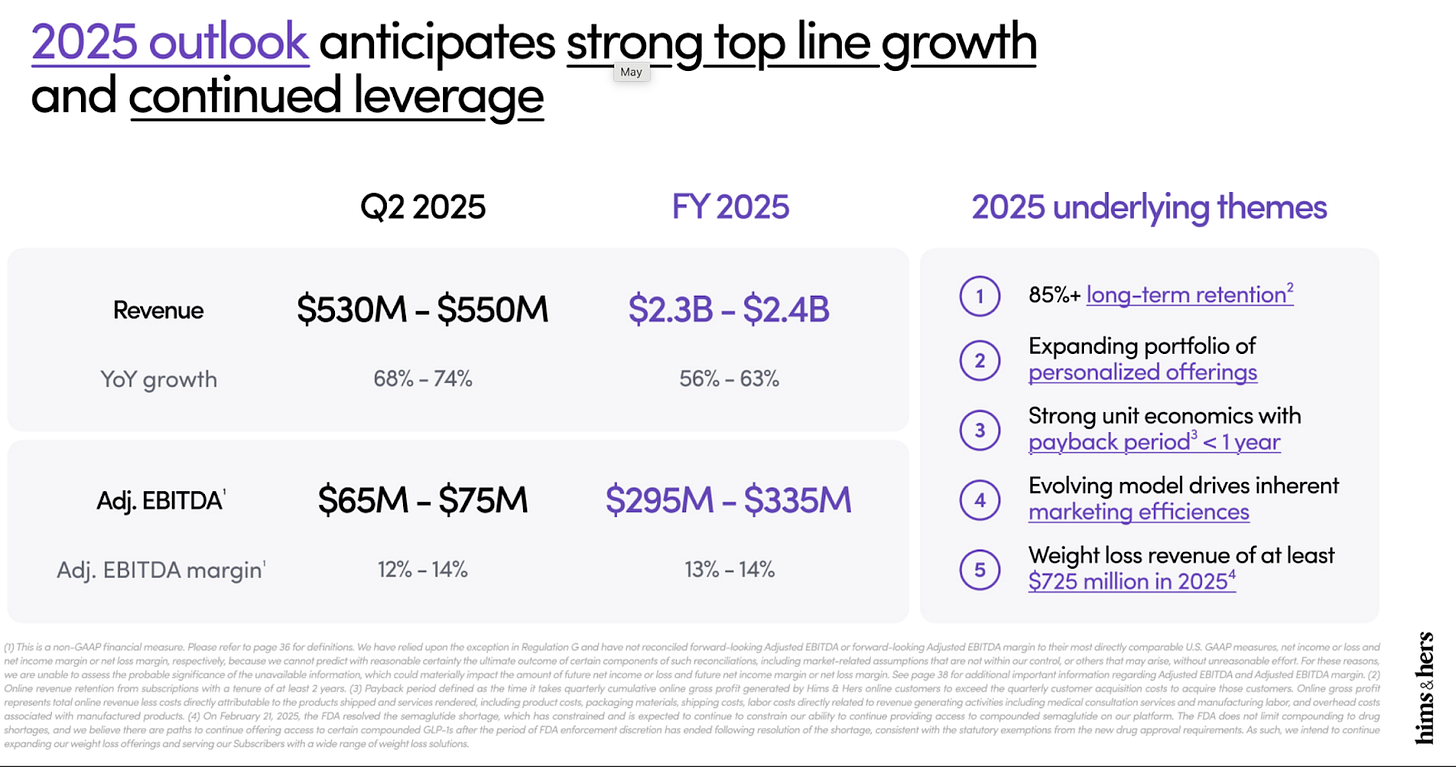

The company-s recurring revenue model continues to drive revenue growth and margin expansion, with Adjusted EBITDA margin now at 4%.

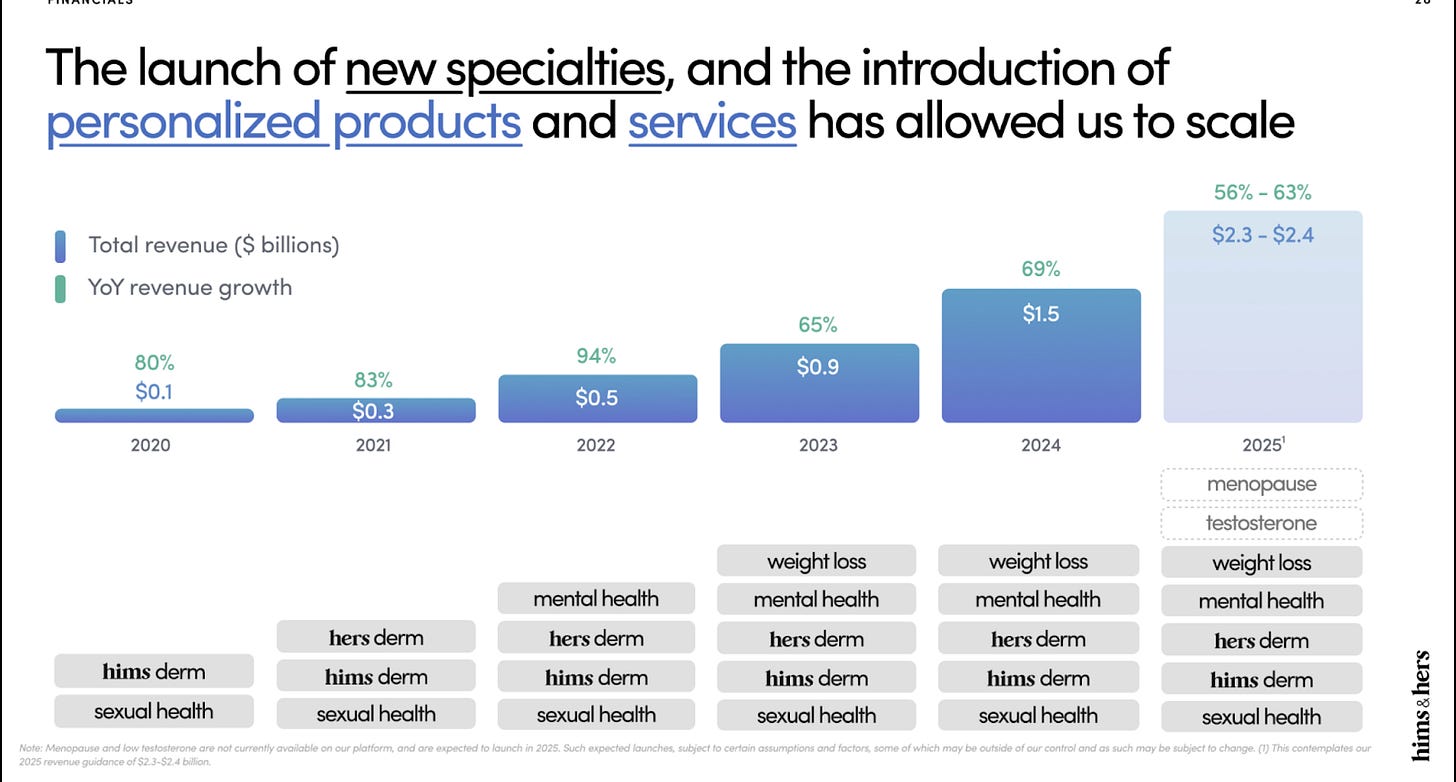

While the company has been mostly known for its weight loss drugs, it is expanding across multiple different specialties, with new verticals such as menopause and testosterone coming online in 2025.

The company expects to achieve $6.5 billion in revenue by 2030.

More immediately, HIMS aims to grow revenues to $2.4 B in 2025.

As a company that is quickly growing, HIMS has also announced some important strategic moves. For example, Hims & Hers appointed former Amazon executive Nader Kabbani as Chief Operations Officer.

HIMS vs Palantir

Few companies have done as well as HIMS in the last year. Perhaps the only one that is comparable is Palantir.

It’s actually very interesting to see that the HIMS and PLTR stock prices often move in sync.

This can be explained, in my opinion, by the fact that these are two very popular “retail” (or even meme) stocks.

A lot of investors gravitate towards these stocks due to their high volatility, but there’s in fact some other key similarities between these stocks.

Growth Narrative

Precisely another key reason why investors gravitate towards these stocks, is their compelling growth narratives. Palantir is at the forefront of AI, while HIMS is leading a revolution in tele-healthcare.

Both high growth segments and it's not just narrative, with both of these companies actually delivering very strong growth in 2024.

Platform Centric

Both HIMS and PLTR, though very different in terms of their clients and service, are both actually underpinned by their platforms.

Palantir more so now with AIP, and HIMS though its online platform, which makes the whole healthcare process a lot more seamless.

Platforms are scalable, and easy to understand and this is why these stocks can also command a high valuation premium.

Ultimately, we have two companies that are

Accelerating growth

Operating in a high growth segment data/Ai and healthcare

Have the potential to be very profitable as they scale

Loved by retail investors

Are or were are one point heavily shorted

Why HIMS Could Be Even Better

But if you’re looking to get into one of these stocks, I would now argue that HIMS is the better choice due to a few simple reasons.

HIMS is B2C

I would argue that HIMS’s B2C model has more long-term potential and makes it a better business.

Palantir, at least for the time being, is heavily reliant on large government contracts. This makes its revenues more unstable and dependable on one client.

In fact, part of the reason I am very bullish on Palantir is theri move to serving the commercial side through AIP. But this is still in its early days.

HIMS is already a household name, and it has a much easier time in capturing new clients, achieving recurring revenue and expanding the LTV of its customers.

AI vs Healthcare

Which is a better business to be in. Healthcare or AI? These are both broad segments, and in reality they are going to strongly overlap.

However, I would argue that there’s more potential in healthcare, which is ultimately a human necessity. AI will become a tool to perfect healthcare, but the latter is closer to the consumer and therefore has more potential.

I’ll concede that this is maybe not such a definite win for HIMS, if Palantir can ultimately become the backbone of industry and business through their AI, but does this justify the disparity in the valuation.

Valuation

HIMS is a better business for investors, with a large TAM, low CAC and high LTV. But it’s way less expensive than Palantir.

Palantir trades at an FY2 PE of 152, compared to HIMS’s 38. Palantir also commands a P/S over ten times that of HIMS and twice the Price/Book value.

And if we actually look at Cash flow, HIMS isn’t that unreasonably priced trading at 35x cash flow, while again Palantir trades at nearly 200x its cash flow.

HIMS is a better choice at these levels, and the fact that Palantir can reach such valuations/ makes me quite confident that HIMS could continue to rally for many more months, especially with short interest still so high.

Risks

It’s worth mentioning that in spite of strong Q1 results, the company faces potential headwinds.

Most of all, there's still a lot of uncertainty regarding semaglutide and other weight loss drugs. However, these risks are becoming less as HIMS is striking deals with the major pharmaceutical companies.

It’s also true that the gross margin has declined from 82% to 73% as the company scales rapidly and due to a different product mix. It is true that margins could keep contracting, especially if more competitors come into the market.

Final Thoughts

Overall, HIMS continues to be a fantastic company. While there’s no doubt that the recent price surge is partly due to a short squeeze, I do think the company deserves a premium valuation, much like Palantir.

🚨 HIMS is the best performing stock in our YOLO portfolio, which is up 70% since inception.

High Conviction. High Velocity. YOLO Portfolio is where macro meets momentum. We take bold, calculated swings on asymmetric trades with explosive upside.

Join now and see what smart speculation really looks like.