Most Exciting IPO Since Palantir —Redefining Finance At Scale

US government says Stablecoins are here to stay

TL; DR: Stablecoins just went legit — now what?

The GENIUS Act has cleared the Senate, giving digital dollars like USDC a regulatory greenlight.

Circle, CRCL 0.00%↑ already compliant, could be the biggest winner.

But can it turn reserve yield and APIs into a $100B business?

Will stablecoins replace credit cards?

What happens to Tether now?

In this post, we unpack the bill, Circle’s roadmap, and whether this IPO is the best way to bet on the future of money.

Circle is perhaps the most exciting IPO I have witnessed since Palantir $PLTR.

Most of my posts are around 1000 words long. This one is over 2000 words in length. Take that as a measure of my excitement.

I am adding Circle to my YOLO portfolio

Landmark Regulation Puts Stablecoins on the Map

The U.S. Senate has just passed the GENIUS Act, a landmark piece of legislation that gives stablecoins their first clear legal framework in the United States. Approved by a decisive 68–30 bipartisan vote, the bill marks a pivotal moment in crypto’s journey from speculative curiosity to recognized financial infrastructure.

For the first time, dollar-backed stablecoins like USDC will operate under federally mandated rules. Issuers must maintain full 1:1 reserves—held in cash or U.S. Treasuries—alongside monthly transparency reports and strict compliance with anti-money laundering (AML) and sanctions laws.

This isn’t just regulation—it’s recognition. After years of operating in a legal grey area, Capitol Hill is finally drawing clear lines around one of the fastest-growing sectors in crypto. The bill now heads to the House, where it could be merged with companion legislation like the STABLE Act or CLARITY Act. President Trump has already voiced support and urged passage before the August recess.

Winners? Circle’s USDC already complies with the new framework.

Losers? Offshore players like Tether now face a higher bar for transparency and regulatory oversight.

This vote cements stablecoins as part of the modern financial system. It’s a historic regulatory green light—and a clear message: crypto is here to stay, and Washington is finally catching up.

Why Stablecoins Matter

Stablecoins are crypto native assets pegged to fiat currencies like the U.S. dollar.

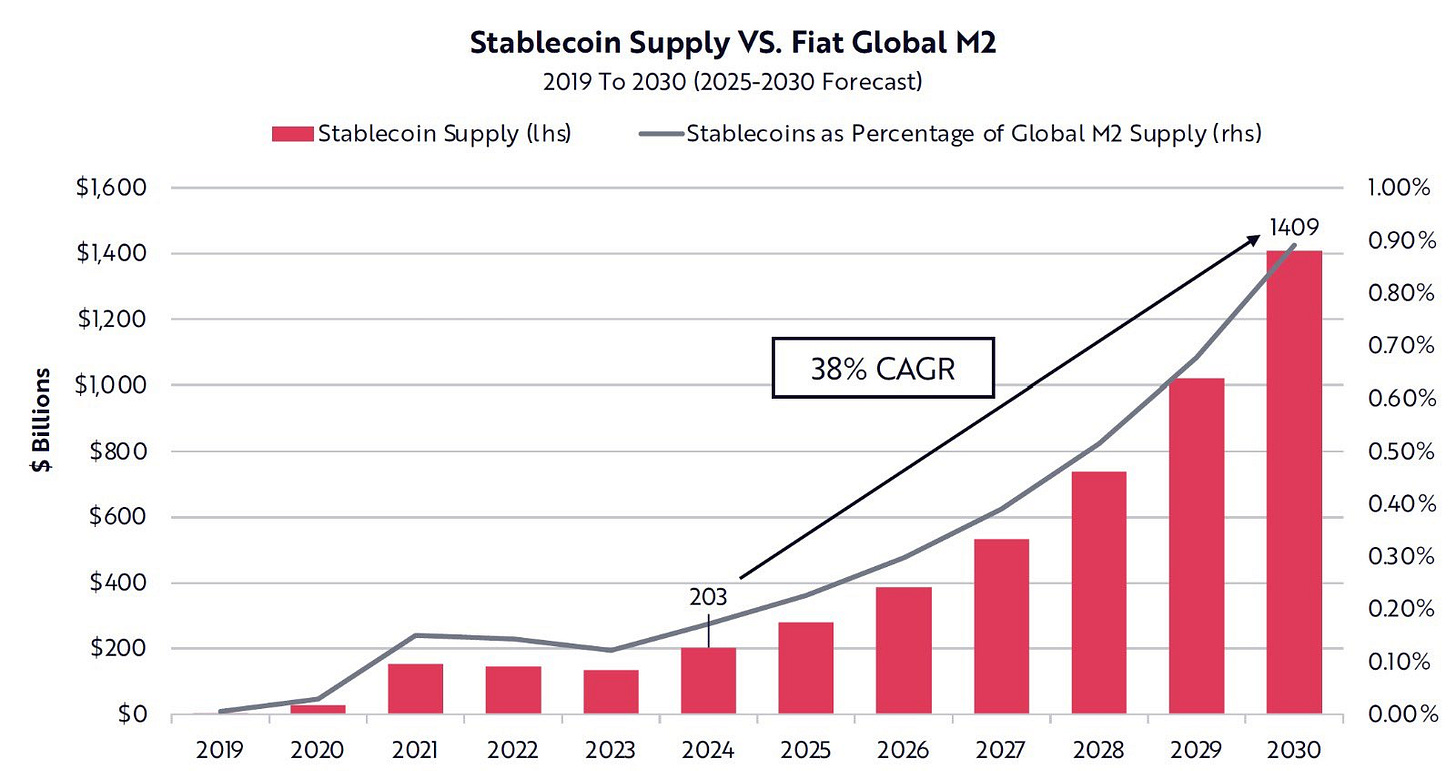

What began as a workaround for crypto traders has evolved into a global settlement layer. Stablecoins now underpin cross-border payments, decentralized finance (DeFi), and, increasingly, commerce. Their benefits are clear: low fees, fast settlement, 24/7 uptime, and on-chain programmability.

Yet their rise hasn’t been without friction. Regulatory uncertainty, especially in the U.S., has hindered adoption by enterprises and financial institutions. The GENIUS Act aims to resolve that, providing a framework that lets stablecoins scale without fear of regulatory whiplash.

Phase 1: From Trading Tool to Trusted Asset

The original use case for stablecoins was simple: solve the broken settlement rails of crypto markets.

Before stablecoins, traders moving between fiat and Bitcoin faced delays and risks. Wire transfers could take days—especially over weekends—while crypto moved instantly. This mismatch created liquidity gaps.

Tether (USDT) emerged as the first real solution: a crypto dollar that could move anywhere, anytime. Despite concerns over reserve transparency, Tether became the dominant stablecoin—especially on the fast, low-cost Tron network. Its role as a “wire replacement” made it indispensable to trading desks, especially in emerging markets.

Phase 2: USDC and the Rise of Programmable Money

While Tether addressed speed, it lacked transparency. That created space for a new contender: USDC, launched in 2018 by Circle in partnership with Coinbase.

USDC was built for compliance and composability. It introduced regular reserve attestations, full dollar backing, and tools like remote burn to manage illicit activity. Unlike Tether, USDC was designed to integrate seamlessly with smart contracts.

That made it the stablecoin of choice for the emerging DeFi sector. From lending protocols to automated market makers, USDC became the currency of programmable finance.

With its regulatory-first approach, USDC redefined what a “trustworthy” stablecoin could look like—and laid the groundwork for mainstream adoption.

Phase 3: Real-World Utility

As stablecoins matured, so did their use cases. DeFi proved the model, but the bigger opportunity was in real-world finance—particularly cross-border remittances.

Legacy payment corridors are slow and expensive. Fees of 5–10% are common, and transactions can take days. Stablecoins, by contrast, are near-instant, global, and cheap.

In regions with limited banking infrastructure or volatile currencies, stablecoins offer a lifeline. While remittance volume via stablecoins is still small in absolute terms, the user impact is massive—and growing.

This marked Phase 3 of stablecoin adoption: practical utility beyond crypto.

Regulatory Clarity: The Missing Piece

Despite growing traction, stablecoins have operated under uncertain regulatory assumptions. Key concerns included:

Disintermediation: Stablecoins could reduce reliance on banks by becoming a direct store of value.

Systemic risk: Issuers holding large amounts of Treasuries might impact funding markets.

Consumer protection: Lack of clarity on redemptions, risks, and disclosures.

Circle’s USDC design is non-yielding fully backed, and U.S.-based custody. These characteristics kept USDC out of the SEC’s reach, avoiding classification as a security or money market fund.

Stablecoins that offer yield directly, however, risk triggering securities laws. That’s why most issuers now rely on third-party platforms to offer yield, technically keeping the coin itself compliant.

The GENIUS Act resolves much of this tension by providing a tailored framework that balances innovation with oversight.

Why USDC Hasn’t Overtaken Tether (Yet)

Despite its advantages, USDC hasn’t dethroned Tether in terms of market cap or usage volume.

Why? Because of differing user bases.

USDC is favored by U.S.-based institutions, DeFi users, and regulated fintechs.

Tether dominates in emerging markets, offshore exchanges, and peer-to-peer use cases.

Tether’s advantage is speed and cost—especially on Tron—while USDC’s advantage is trust and compliance. The two have evolved to serve different markets.

That said, the new regulatory clarity may accelerate USDC’s growth, especially as more enterprises and governments demand transparency.

The Next Frontier: Stablecoins as Cards

The next battle? Payment processing.

Today, Visa, Mastercard, and banks collectively take ~3.5% per transaction in fees. Here’s how that breaks down:

~3% to issuing banks

~0.25% to the payment processor

~0.25% to the card network

Stablecoins offer a better solution:

Instant settlement

No intermediaries

Near-zero fees

No chargebacks

Fintech leaders like Stripe are already experimenting with stablecoin payments. If successful, this shift could challenge the entire card stack.

This is more than evolution—it’s disruption. Stablecoins could soon become not just a better wire, but a better card.

Global Stakes: Monetary Power in the Digital Age

As stablecoins go global, they raise deeper geopolitical questions:

Will they accelerate dollar dominance, or challenge it?

How will central banks react if stablecoins displace local currencies?

Can China’s ECNY gain traction as an alternative through its Belt and Road partnerships?

The dollar currently backs 99% of stablecoin supply. That may seem like a U.S. advantage—but it’s also a vulnerability. If demand shifts, or if foreign governments accelerate their own digital currencies, Circle and other dollar-based issuers could face headwinds.

Stablecoins are more than financial instruments. They are tools of economic influence, and the race is already on.

Final Thoughts: Who Controls the Rails?

Stablecoins are no longer fringe tech. They are evolving into the backbone of a new financial operating system.

Tether solved speed.

USDC brought trust and compliance.

DeFi proved the utility.

Remittances and payments are scaling fast.

Card-level disruption is next.

The GENIUS Act is a milestone, not a finish line. As stablecoins mature, the real question becomes: Who will control the infrastructure of programmable money?

The race is on—among stablecoin issuers, governments, fintechs, and the world's largest financial institutions.

This much is clear: the rails of money are being rebuilt in real time, and stablecoins are leading the charge.

Now, it’s pretty clear how we can profit from this.

Circle IPO’d on June 5th at $31. It closed the day at $80 and now trades at $150.

Despite this huge rally, I believe this could be the opportunity of a lifetime.

We’ll be covering Circle in detail below.

Business Model

Future Outlook

Valuation

TAM

Risks

Let’s dig into it.

Keep reading with a 7-day free trial

Subscribe to The Pragmatic Investor to keep reading this post and get 7 days of free access to the full post archives.