Markets rally on Jolts, but inflation is stubborn.

September is usually bad, and here are a few reasons why we could sell off.

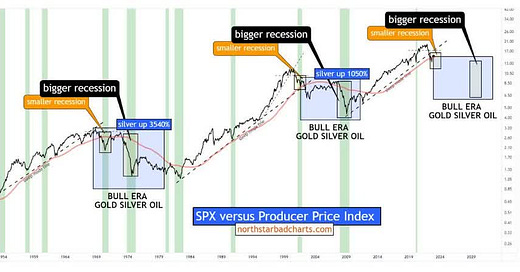

In the long term, we have great opportunities in certain commodities and countries.

Overview

Following a weak JOLTS report, markets managed to shake off a long losing streak. Bitcoin also joined the party, as Greyscale had its Bitcoin ETF approved.

Since then, crypto has slid back down while the Nasdaq has been grinding higher. But what will we see in September? Are we in for a re-test of the lows or new ATHs?

With inflation data coming in for the US and Europe, the likelihood of more rate hikes is increasing, and this could put a dampener on the current narrative.

The way I see it, Treasury rates and the dollar could still have a bit higher to go, which will put some more pressure on the market.

In terms of actionable trades, I do think gaining exposure to some European and Emerging Market Bonds could be a good idea here.

I’m also taking the chance today to, once again, highlight some of my most bullish long-term investing ideas. My favourite country to invest in and my favourite commodity.

Macro Outlook

Stocks popped on Monday following weaker JOLTS data.

As I mentioned back on Monday, bad news is good. But today’s PCE data should have the opposite effect on markets.

YoY PCE ticked up to 3.3%, a little over the TEForecast but pretty much in line with expectations. Still, this clearly shows that the inflation fight is not yet over and that there’s still more work to be done. MoM has held steady at 0.2%

It seems the JOLTS data is weighing more on markets. Since the report on Monday, expectations for a rate hike in November have actually decreased.

These were peaking at around 50% on Tuesday.

Tomorrow, we’ll get some more key employment data and PMI.

Europe and China

Moving our attention overseas, Europe has been struggling with both weak economic data and, as of the latest report, stubborn inflation.

Overall inflation in the 20 countries sharing the euro was unchanged at 5.3% in August, defying expectations for a drop to 5.1% as energy costs rose sharply over the month, Eurostat data showed on Thursday.

Source: Reuters

On Monday, we saw loan data in the EU come in weaker than expected, as did M3 money supply:

Overall, though, I’d say the EU looks to be closer to ending its hiking cycle. We are seeing notably more weakness, and some leading inflation indicators are pointing us more sharply down.

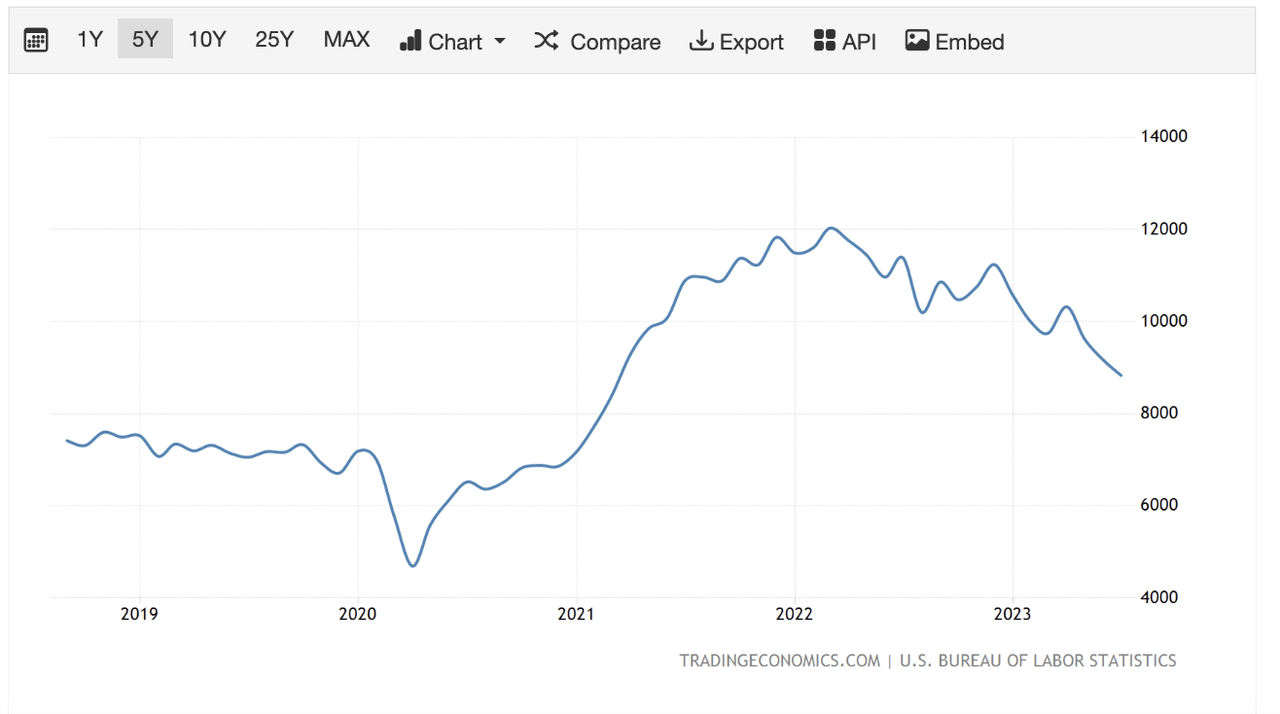

As we can see pointed out here by Steno Research, PPI in France is suggesting inflation should trend quite aggressively down in the coming months.

Moving on to China, the bad news keeps piling up.

Looks like Country Garden is going the way of Evergrande.

Meanwhile, Non-manufacturing PMI came in below expectations:

And investors keep pouring out of Chinese equities, with over $10 billion of outflows.

How much can China do to stem this, and what will the effects be for the rest of the world? The largest “concern” at the moment is that China will be exporting deflation to the rest of the world.

September sell-off?

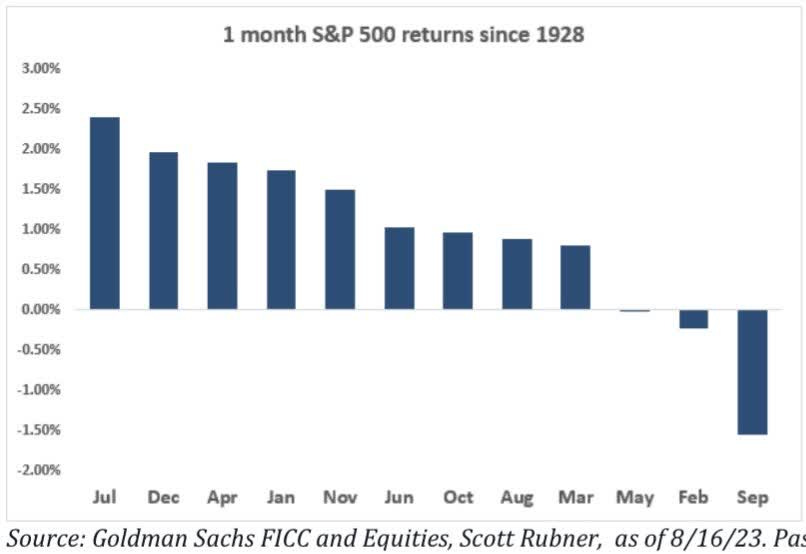

Yes. Traditionally, September is not a great month for stocks.

With that said, let’s put things into perspective. The average return for September is around -1.5%. Percentage-wise, stocks have fallen in September around 55% off the time, which means that this is essentially a coin flip.

Furthermore, investors betting against stocks in September since 2014, would have lost money with this strategy.

But here are a few reasons a September sell-off could be in the cards.

Renewed Stress In Banks

The Federal Reserve has quietly issued warnings to regional banks.The bank regulator is telling the regional lenders to strengthen their liquidity planning, as it starts to tighten supervision in the months that followed the failures of three banks this spring, Bloomberg reported, citing people familiar with the matter. The warnings have addressed a wide range of issues, including capital, liquidity, compliance, and technology, they said.

Source: Seeking Alpha

As I’ve warned before, the situation with banks continues to be delicate. Rates today are essentially at the same level as back in March, so these balance sheets aren’t looking any better.

Stress In Real Estate

The Real Estate market could also, in my opinion, be closing to buckling, and this would no doubt translate into stress for equities. The worst hit will of course be commercial real estate, which in turn will be a big drag on Regional Banks.

Prices have already come down significantly from their peak, but they could have a lot further to go. Many companies are pushing hard to get workers into the office, but it just ultimately doesn’t make sense. Technology has changed things for the better, and though yes, a restructuring of commercial real estate will hurt the economy, companies stand to save a lot more money in the long run.

The housing market is, on the other hand, showing some stronger resilience. But there are some imbalances that could begin to unwind eventually.

Of course, housing affordability is incredibly bad at the moment. Noone is looking to buy a house at the moment, with mortgage rates near 7%.

However, no one is really looking to sell either. US listings popped up in August, but the overall supply of housing is still low.

Sure, someone who owns and lives in a house, and might be looking to sell, can hold off for a few years, but the same can’t be said of those that rely on income generated, and this is the case with Airbnb/short-term rentals.

This market has been booming. Everyone wants to live off of Airbnb renting, and it’s just not sustainable, in my opinion.

The competition is getting fierce, and as I mentioned in the video update, we are already seeing big declines in the income these can generate. This could, eventually, lead to a big rush of supply to the market in an environment where demand is still very tame.

Market breadth

Market breadth peaked back in August, and now, over 50% of stocks are below their 50-day moving average. This could be a sign of further weakening in stocks.

Dollar And Treasuries

Dollars and treasuries have held a pretty good correlation with stocks. Dollar down, stocks up, rates up, stocks down, and vice versa.

The dollar is now finding support at the 200-day MA. Again, nothing is immediately bearish. If anything, we look ready for a turn pretty soon. We have some room to run on the RSI, and my target continues to be for a retest of the (A) wave high.

In terms of Treasuries, TLT is currently suggesting that we should have one more low to come. I see a five wave structure from the 2022 high ending soon. The recent sideways action could be described as an ABCDE distribution in circle wave iv.

If we get into the micro off the last move we could argue that the recent rally is a wave iv, meaning we should soon enter the last leg down.

Technical Outlook

SPX is at a key inflexion point. The prior trendline now caps the current rally. We are also just below the 78.6% retracement. In other words, this is the place to turn.

If we were actually to rally above 4550, then we’d have to look at potentially higher highs in the more immediate future.

So far, though, we want to retest the recent lows. A wave IV should take a bit longer, and we have so far only made a three wave rally off the lows.

More Charts: USO, UNG, Uranium

USO bounced exactly where you’d expect, finding support in the trendline. Here, we can definitely make an argument for a low being in. Yes, ideally, we’d see a lower low, but this has retraced near its ATHs, and the MACD is close to a bullish crossover. We are getting overbought on the RSI, though.

Natural gas has been coiling up, and though we did get a lower low, we are now back above support. My conviction in this both in the short and long-term hasn’t changed.

We haven't looked at uranium for a while, and we are long through our holdings of CCJ. The way I see it, this is following a pretty clean structure to finish off a wave V. We could expect a bit of a pull-back now in 4 as the weekly RSI resets.

Show Me The Money

Overall, we are approaching the end of the hiking cycle, and history suggests that we are a few quarters away from a major market sell-off. I’d still expect to make higher highs before that, but as I’ve mentioned many times before, there are better places than US stocks long-term.

Keep reading with a 7-day free trial

Subscribe to The Pragmatic Investor to keep reading this post and get 7 days of free access to the full post archives.