Selling Like Warren Buffett, Buying Like Charlie Munger; 2 New Swing Trades

The 200 week EMA is the place to be

TL;DR

Markets continue to sell off and investors are becoming rightfully concerned.

Nonetheless, this opens up some great opportunities for buying great companies at a fair price.

In the words of Charlie Munger

"If all you ever did was buy high-quality stocks on the 200-week moving average, you would beat the S&P 500 by a large margin over time."

Three things are required to do this:

Cash

Patience

Knowing What Quality Company Is

We raised cash last week, as momentum shifted, and now we are getting ready to put this wisdom to work.

Expect To Learn:

Outlook For S&P 500, Nasdaq And Bitcoin

My favourite Companies Trading Just Above The 200 Weekly EMA

Two High-Quality Stocks I’m Looking To Add to Our Swing Portfolio

Market Update

Nothing has changed since last week, and the selloff has intensified this Monday.

S&P 500

Since we’re talking about 200 EMA’s today, let’s look at the weekly chart.

For SPX, the 200 EMA gets us down towards 4600, which would be a full-blown bear market.

If we get there, obviously a great chance to buy. Will we get there?

Personally, I think the Fed will step in to provide some relief before it gets that bad. I’ve marked my buy zone in the rectangle.

At 5300, the first key fib level I start dipping my feet. If this is just a correction, then we should quickly reverse back to that zone.

NDX

NDX is already below its 50 week EMA, and fast approaching the 38.2% retracement level. A potential place for a first buy. Notice the RSI is inching toward oversold. I’d expect to see at least a technical bounce over the week.

Bitcoin

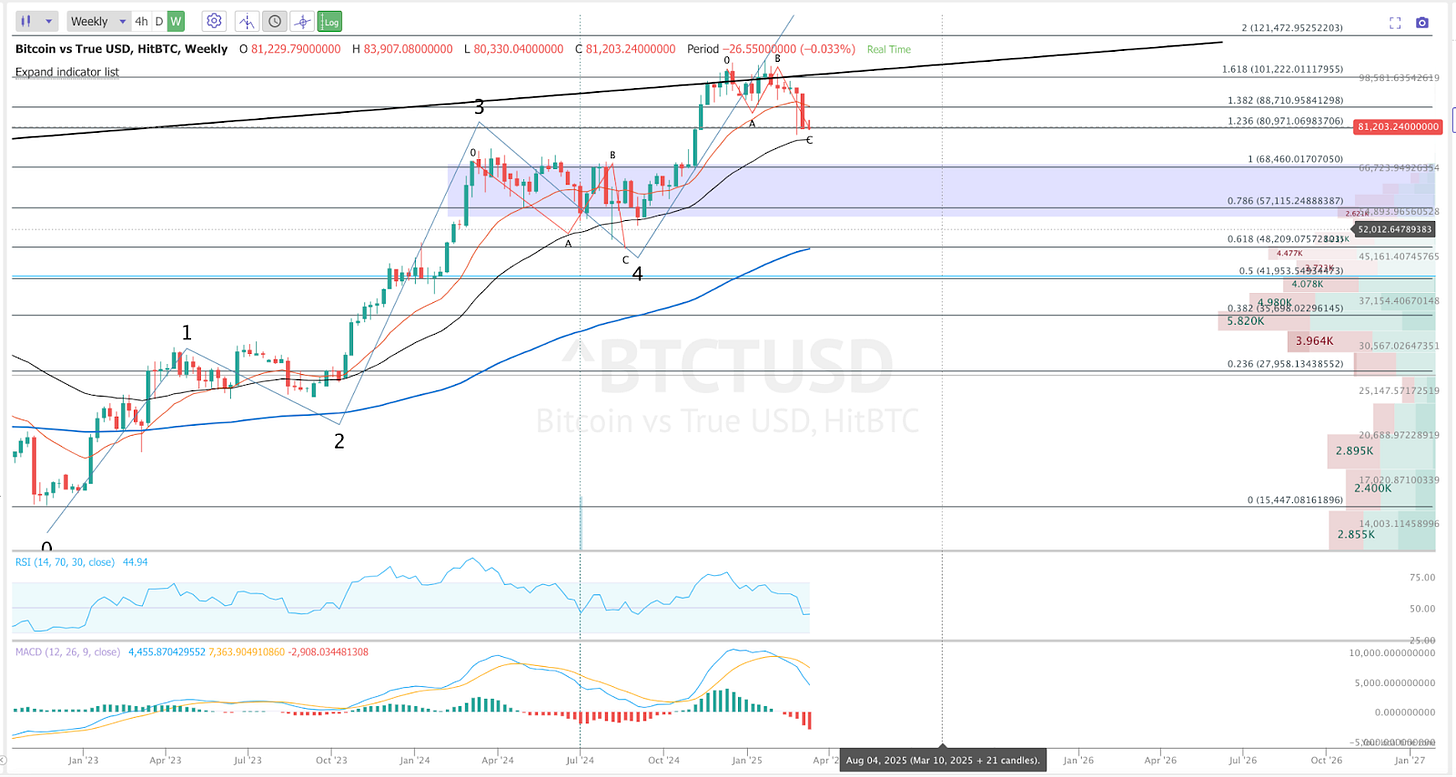

And while Bitcoin is not a stock, and was not what Charlie was thinking when he said the quote above, let’s take a look.

The 200-week EMA gets us down to 48,000, but I think a reversal within the highlighted area is more likely.

Ultimately, I don’t think the 200 EMA is the most likely scenario for these charts, but as investors, we have to be ready.

Is this a scenario you can tolerate?

Will you have what it takes to buy at those levels?

Buying Stocks At The 200 Week EMA

Now, let’s look at some specific stocks that are hanging out just above their 200-week EMA.

Using Trendspdier, I developed a quick scanner to search for stocks that were within +5% above their 200 weekly EMA.

You can view the full list here.

And here are the 3 opportunities that stand out to me.

It's interesting to point out that many of these stocks aren’t any of the high flying stocks, since these still have a ways to go until they reach the 200 week EMA.

Instead, they are beaten-down stocks that have actually been outperforming in the last week. I’d even say they are recession-proof to an extent.

Keep reading with a 7-day free trial

Subscribe to The Pragmatic Investor to keep reading this post and get 7 days of free access to the full post archives.