Overview

2023 is almost behind us, and many would argue so is inflation.

As Christmas time approaches, it appears that investors have been nice this year, and their wishes have been fulfilled.

The SPX hovers around all-time highs.

Bitcoin is well above $40,000

Altcoins have sprung back to life

Small-caps have joined in the rally

US GDP grew 5.2% last quarter

The Fed will begin to cut rates

Even bonds are rallying

But how can this be? We’ve had the most aggressive monetary tightening of the last 50 years, and yet the economy remains strong, AND inflation seems to have been conquered.

In this write-up, we will address:

Why inflation has actually fallen

Why rate hikes have not had such a negative impact on the economy

Why the economy actually seems so resilient

Why the path of least resistance now is for inflation to return

Why and how a deflationary recession could be triggered.

So grab a cup of hot coffee, curl up by the fire and enjoy.

Macro Outlook

Let’s keep things simple. Over the last few months, I have come to realize that most of the disinflationary pressure which we have experienced over the last year is not due to the Fed.

Rather, this can be attributed to the reversal of many of the imbalances generated during the COVID pandemic.

This was recently pointed out by the Council of Economic Advisors:

The report concludes that around 80% of the inflation could be attributed to transitory supply-side factors.

During the pandemic, we had a boost in demand brought about by monetary and fiscal stimulus, while supply chains were constrained. An imbalance which led to higher prices but which has now mostly dissipated.

If we look at PCE minus food, energy and housing, we are now below the 2% YoY target.

If anything, there’s an argument to be made that the Fed was too loose while inflation was climbing, with real rates well in the negative.

The actual 1-year treasury rate didn’t begin to pick up until 3 month fwd inflation had already peaked.

Both monetary and fiscal policy have been loose, which explains why the economy has held up so well.

From a monetary standpoint, bear in mind the following:

Real rates, that is, nominal rates minus inflation, were negative

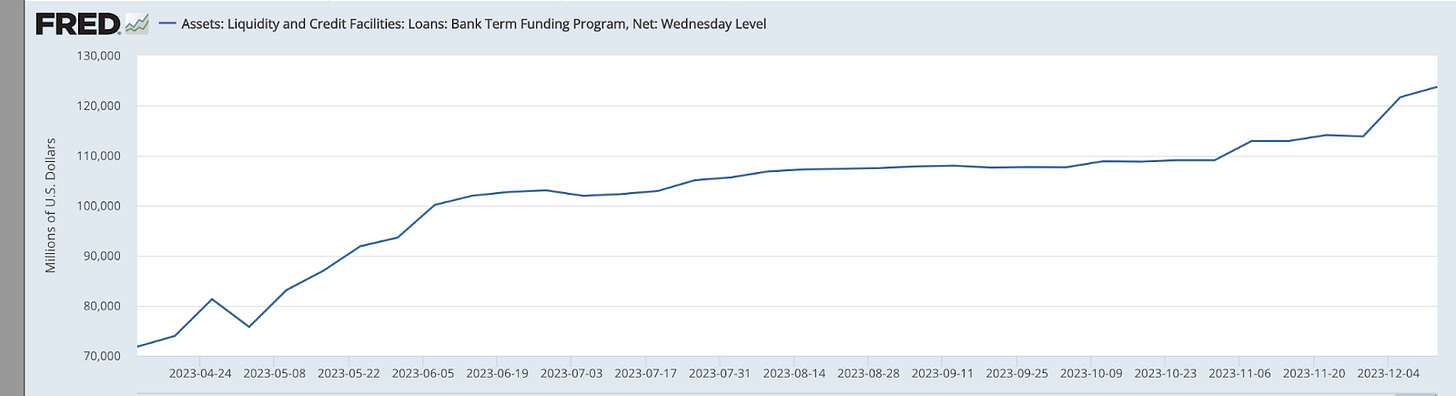

The Fed initiated the BTFP in March

The Reverse Repo facility had $2.5 trillion at its peak, now down to around $800 billion.

A couple of very interesting things to note here.

The usage of the BTFP began to pick up again towards the start of November

The reverse repo facility is getting close to being depleted

Both of these metrics have contributed towards adding liquidity to the US markets.

Furthermore, in recent months, global liquidity has risen as a lot of foreign central banks have begun to cut.

We can see that global liquidity, shown in blue, began to turn just as the SPX bottomed in October.

So, from a monetary perspective, we have actually been quite accommodative, and will be even more accommodative in 2024.

And then, of course, there is the fiscal side.

The printing press is indeed on, but it is held by the Treasury, not the Federal Reserve. The spending is comparable to World War I and II. Except there is no war.

This has been well reported by George Robertson, who is on substack now, definitely go give him a follow.

So, while many were expecting the economy to worsen in 2023, we’ve seen quite the opposite: strong growth and declining inflation.

But what’s in store for next year?

Is stagflation possible?

Moving forward, there are three possible scenarios.

Soft landing is achieved, inflation remains around 2-3% and growth normalizes

The economy heats up again, and inflation picks up, potentially leading to a stagflation.

The black swan event triggers a credit collapse which takes us into a deep deflationary recession.

Firstly, what are the odds the Fed has achieved a soft landing?

Scenario 1

A soft landing is rare. The Fed last pulled one off in 1994, an occasion that some economists call a “perfect” soft landing. Inflation was around 3 percent, and the Fed — which was chaired by Alan Greenspan at the time — was trying to stabilize prices before they shot up. In a series of seven rate hikes beginning in February 1994 and ending in February 1995, policymakers roughly doubled interest rates to 6 percent.”

The result was successful. The economy averted a recession, inflation stabilized around 3 per cent before drifting down, and unemployment continued to fall for most of the late 1990s. Although economic growth weakened in the first half of 1995, it later rebounded, and a period of strong expansion followed. The Fed later lowered interest rates to 5.25 per cent in January 1996 before raising them again to 5.5 per cent in March 1997.

The US kicked off the 1990s with a mild recession, which happened as oil prices rose and inflation was near 6%.

The Fed cut rates aggressively down from 10% to under 4%, and then began hiking back in 1994, carrying out seven rate hikes.

Inflation did stabilize around 2%, and the US economy avoided a recession. But it’s hard to know just how much the Fed had to do with this.

The 1990s stock rally was supported by technological innovation, which in turn created strong growth and disinflationary forces.

Could the boom in AI create the conditions for another decade like this?

The analogue does look compelling:

Scenario 2

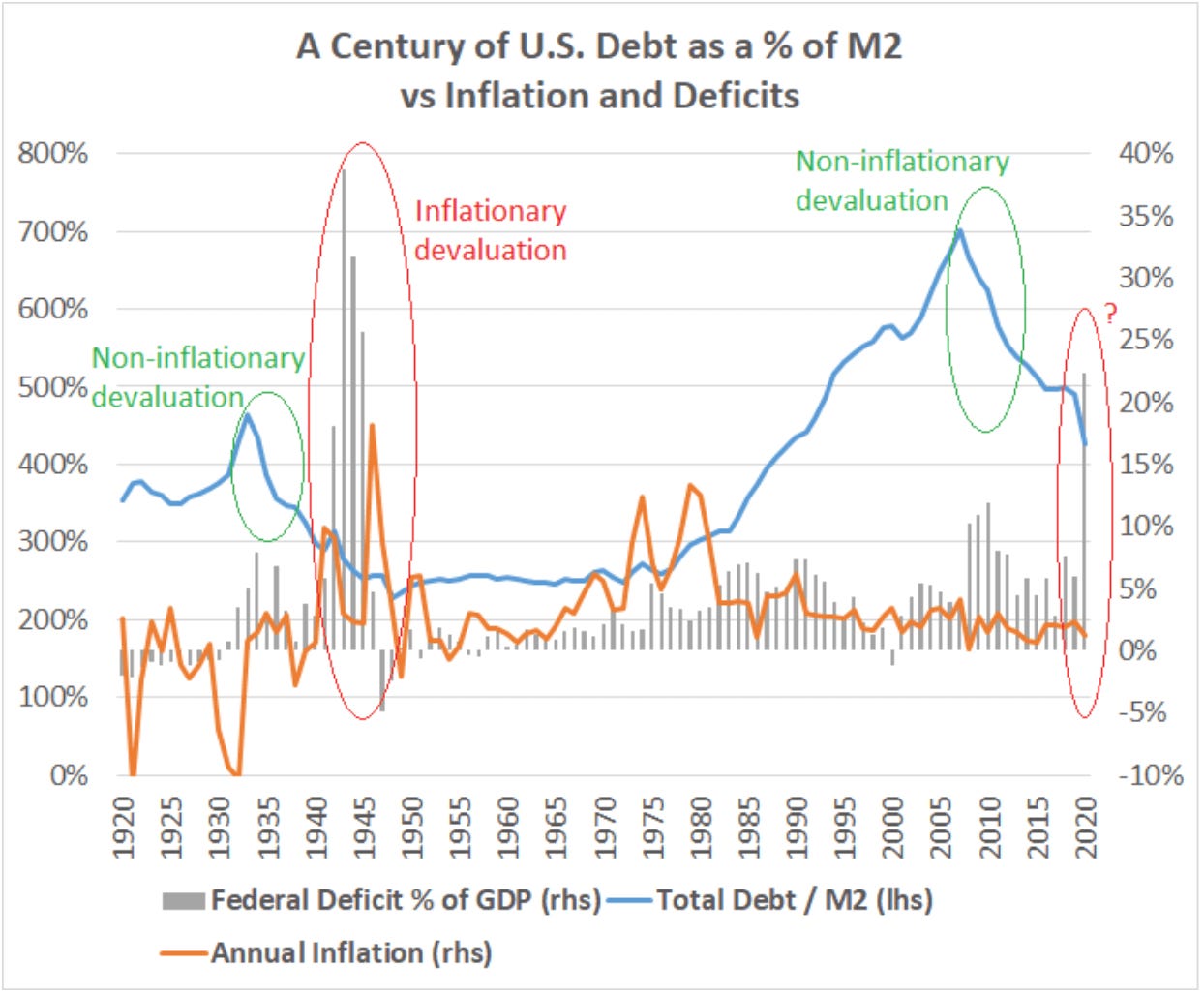

With that said, the current trend of elevated fiscal spending could eventually lead to inflation. Much like it did in the 40s.

In order to actually produce inflation, we need the supply of circulating money to expand faster than the supply of goods and services.

This could happen if fiscal spending remains elevated, employment remains tight, and the supply of key production inputs, such as energy, isn’t able to accommodate further expansion.

This is certainly something I believe could play out over the next decade as:

Underinvestment in oil production over the last few years begins to affect supply.

Demand for energy greatly increases due to the demand from new AI applications.

More immediately, I’d only see oil prices increase and inflation return if we got some sort of geopolitical shock.

The other variable is wages. What if wages start growing again?

Wage growth is very much tied to core inflation, and according to the NFIB, plans to raise wages have recovered to new cycle highs.

Scenario 3

The risk may now be deflation as the economy begins to cool off. Just look at the monetary contraction over the last year.

In the chart above, we see the change in M2 over the last 180 years. Indeed, history suggests that a negative rate of money growth means trouble.

This actually supports the idea that the Fed should loosen up sooner, and this could be one of the reasons behind the rather sudden change in stance by JPow.

Certainly, there are a lot of charts we could pull out to support the idea of a recession.

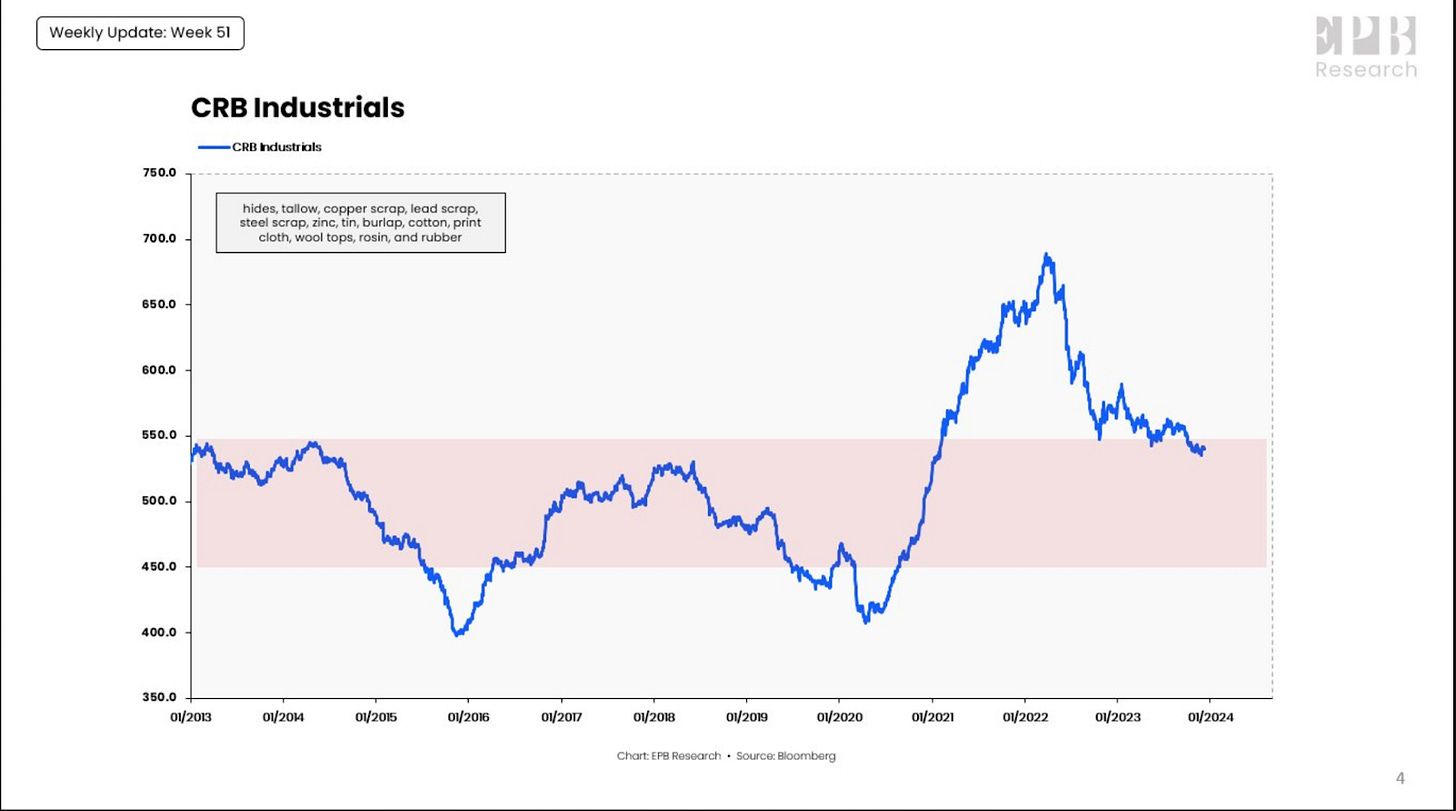

The above chart and the following were posted on X by Eric Basmajian, from EPB research.

Industrial metals have been declining in price over the last few months, even as markets have rallied. This is a strong indication of weak demand.

Eric also points out that the consumer is always strong before a recession. 3 months ahead of a recession, consumer spending averages 2% growth across the last 6 recessions.

And, of course, one could also look at 20 year bonds, and say that these are signaling an economic slowdown.

The way I see it, though, the US economy would need a catalyst to actually kick off this recession.

Remember regional banks and commercial real estate?

Demand for office space keeps plummeting, and vacancy rates reached about 20% in the third quarter. US commercial real estate values have fallen by some 20% between early 2022 and late 2023, and they’ll probably drop another 5% to 15% next year, according to global real estate firm CBRE.”

According to the latest report by the National Bureau of Economic Research (NBER), a collapse of commercial real estate would put 385 banks at risk.

Macro ETF Update: So what’s next?

My primary thesis hasn’t changed. Until I see some weakness somewhere I am cautiously bullish, and will be extremely cautious as the SPX breaks above $50K and Bitcoin reaches new highs.

For now, I am still looking for a pull-back.

Keep reading with a 7-day free trial

Subscribe to The Pragmatic Investor to keep reading this post and get 7 days of free access to the full post archives.