The EOW Portfolio

Welcome to the End Of The World Portfolio. I think the name is pretty self-explanatory.

The EOW portfolio is designed to become the bedrock of our wealth. This is a diversified basket of assets designed to, above all, preserve our wealth and our peace of mind.

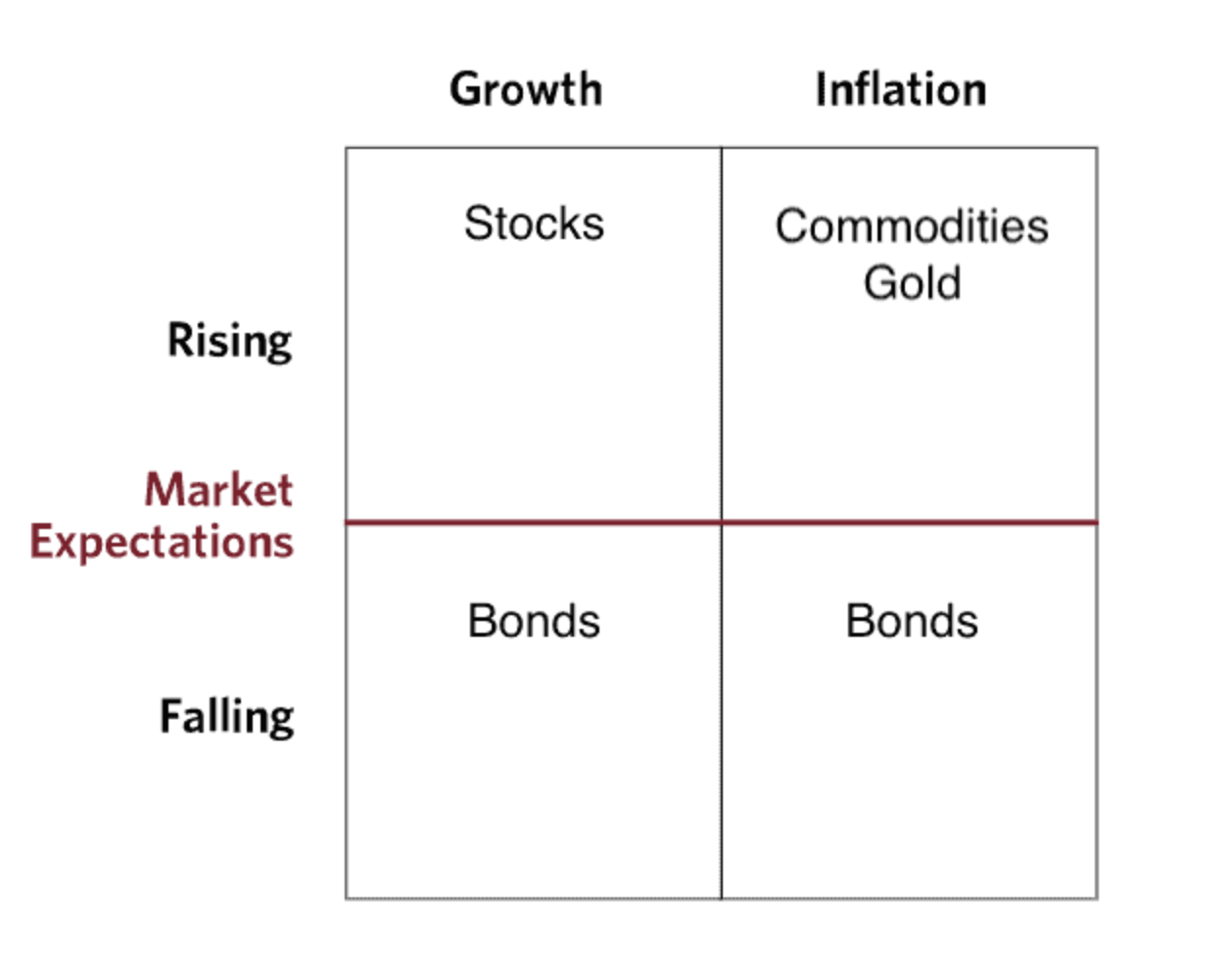

This portfolio is designed to overcome any sort of macro environment, and even perform well in the worst of times, which we can achieve by investing in the right basket of assets.

At its core, we want to expand on the ideas of the All Weather Portfolio.

With the right allocation of Bonds, stocks and commodities, we can build a portfolio that does well in any environment.

We will be focusing on equities in this portfolio. There’s not much mystery to the other assets. Get some bonds and gold to get diversified.

However, picking the right stocks to invest is where the alpha, and fun, will be found.

The portfolio will be available to paid subscribers.

Finding End of World Stocks

We need to invest in equities. Companies are the lifeblood of the economy, and even if we believe that hard times are coming, you want to own companies. But they have to be the right ones.

Here’s what I look for in the stocks I add to the EOW portfolio.

Long-Term Secular Growth

In simple terms, we want a company that is well-positioned to grow over the next 20, 30, or even 50 years. This doesn’t mean that the company needs to be a new start-up that is doubling revenues every year. On the contrary! I’d rather invest in a company that has been achieving steady growth over the past two decades and is in a market that will continue to grow.

This is why I like markets like energy, healthcare, security and to an extent technology, though this is a very wide category.

Diversified Income Streams

Just like you want to have a diversified portfolio, it is best to invest in companies that have diversified sources of revenue. Ideally, a company will have various segments, and operate in various countries. This ensures that there is no single point of failure.

Profitability and Cash Flow

A long-term holding has to be profitable and generate cash. These companies have to be self-sustainable at a minimum. We can’t be betting on companies that are reliant on outside financing and can’t make ends meet.

While I do not need a company to pay out a dividend, companies in the EOW portfolio should be able to.

Balance Sheet Strength

If you were preparing for the end of the world, you’d want to stock up on plenty of things. The same goes for our companies. The more hard assets the better. Even if shit hits the fan, we want our stocks to be able to weather the storm.

Moat

And of course, the moat. In the long term, there’s going to be companies coming and going, new products and changes in markets. Of course, we can anticipate this as investors, to an extent, and open or close positions accordingly. However, on a fundamental level, we want to pick companies that can’t be touched. A moat protects the company from competition and ensures it will be around in the long-term

Closing Remarks

With all of this in mind, we can build our End Of The World portfolio. Despite its name, I don’t think the world is going to end. But as I mentioned in my long-term investment framework, you have to expect the best and prepare for the worst. The EOW portfolio is my best effort at doing this.