This Stock Will Massively Benefit From DeepSeek; Buying The Dip Aggressively

I'm Buying The DeepSeek Dip; See How Below

TL;DR

If it’s not one thing, it’s another. Markets skidded past the BoJ rate hike unharmed, but the new revelations from DeepSeek have sent tech stocks spiralling down. Plus, we have FOMC later in the week.

Is this, yet another market overreaction?

The way I see it, the advancements shown by DeepSeek are actually very bullish for some AI stocks.

Today we finish what we started last week, covering in-depth one of Nancy Pelosi’s latest AI investments:

Expect To Learn:

Why stocks are selling off on the DeepSeek News

Why I believe The Market Has It Wrong.

How This Healthcare AI Stock Will Benefit

In-depth analysis of Fundamentals and Technicals

And stay tuned, because in our next Macro report, I’ll discuss exactly why I think rate cuts are underpriced right now.

Why The DeepSeek Sell-Off?

Tech stocks faced a sharp sell-off after Chinese startup DeepSeek launched a low-cost, open-source AI model, challenging the dominance of Western tech giants. DeepSeek’s assistant, reportedly developed for under $6 million, offers a cheaper alternative to costly AI models by companies like Nvidia and OpenAI. This raised concerns about the sustainability of high investment levels in AI.

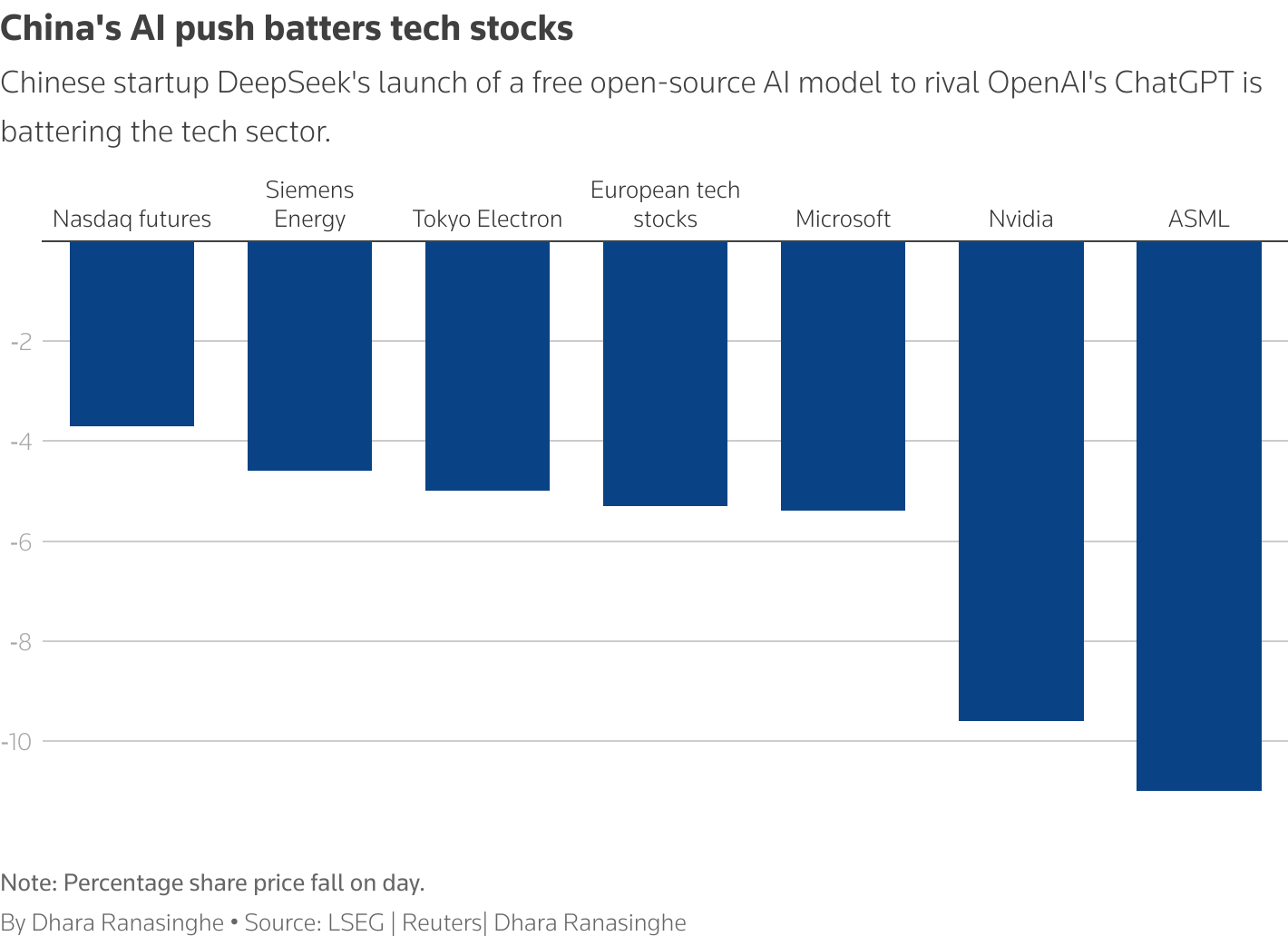

Nvidia shares dropped 10%, Oracle fell 8%, and Palantir lost 7% in pre-market trading. Nasdaq 100 futures slid nearly 4%, while AI-related companies globally, including ASML and SoftBank, also tumbled.

DeepSeek's success, overtaking ChatGPT in App Store downloads, has been called AI's "Sputnik moment." Analysts noted this could lower AI costs for users but questioned the massive capital expenditures of major firms. Optimism surrounding AI had driven tech valuations sky-high, but DeepSeek’s breakthrough has sparked fears of shifting global competitiveness and the re-evaluation of Western companies’ market dominance.

The Market Has It Wrong

DeepSeek’s rise is shaking the tech sector by proving that groundbreaking AI can be achieved with limited resources.

While Western companies like OpenAI spend hundreds of millions on AI models, DeepSeek trained its flagship model for just $5.6 million. Its efficiency-focused approach, combined with open-source development, has driven global adoption and disrupted the AI market, raising doubts about the sustainability of high investment strategies by tech giants.

So, yes, on the surface, this could be bad news for “picks and shovels” companies like NVIDIA and ASML.

But is it that bad news for companies like GOOGL and META?

It seems to me like the DeepSeek development is a step forward in achieving all the benefits from AI and many of these big tech companies still stand to benefit massively.

Furthermore, smaller and more specialised AI companies, like the one we’ll discuss below could benefit even more

In the next section, we will cover this stock in depth:

Products and Fundamentals

Market Opportunity

Valuation

Technical Analysis

Risks

When And How To Buy

I’m adding this stock to our market-beating YOLO portfolio. Consider upgrading to gain access to all the portfolio trades and full macro reports!

Keep reading with a 7-day free trial

Subscribe to The Pragmatic Investor to keep reading this post and get 7 days of free access to the full post archives.