DeepSeek Aftermath; Has The NVIDIA AI Bubble Popped?

Also, learn which stock I'm buying to profit from this dip and AI

TL;DR

The DeepSeek news rocked markets on Monday, though it seems like a lot of tech stocks have bounced back now.

Since the initial release of DeepSeek’s cheaper “ChatGPT Killer”, a lot of new information has come to light, with experts weighing in on what this means for the AI industry.

Has The AI Bubble Popped?

That’s exactly what we will answer below, while also highlighting actionable opportunities for investors looking to profit from these developments.

Expect To Learn:

How DeepSeek May Have Revolutionized AI

How NVIDIA Will Be Affected By DeepSeek

Is NVIDIA A Buy On The Dip?

Who Are The Winners And Losers Of DeepSeek?

One Stock That Will Benefit From DeepSeek

This post includes actionable investment ideas, including a very high potential play in the AI space I highlighted to subscribers back on Wednesday. Make sure you make it to the end to find out what stock this is, and if you enjoy the content, don’t forget to like, share, and subscribe!

DeepSeek or DeepFake?

DeepSeek, a Chinese AI startup, launched DeepSeek R1 on January 20, 2025. This AI assistant has made waves for its power and cost-effectiveness, being compared to leading models such as OpenAI’s, but developed for only $5.58 million, a fraction of what major firms typically spend.

This efficiency has led to market disruptions, with companies like Nvidia seeing dramatic declines in valuation, including a $600 billion drop in one day. The Trump administration is investigating if DeepSeek obtained advanced Nvidia chips through Singapore to bypass U.S. export restrictions, fueling further questions about its model’s legitimacy. High-profile figures like Elon Musk have raised doubts, pointing to Singapore’s significant contribution to Nvidia’s revenues and questioning how DeepSeek built its AI without top-tier Nvidia chips.

How Does DeepSeek Change The AI Landscape?

DeepSeek is changing the AI sector in several impactful ways:

Cost Efficiency – DeepSeek trained a high-performing AI model for under $6 million, challenging the belief that AI development requires billions. This cost efficiency could disrupt established players like OpenAI and Google, who typically spend vast amounts on AI.

Market Disruption – The rise of DeepSeek led to a $1 trillion selloff, especially affecting companies like Nvidia. Investors now question whether Nvidia’s chips are as critical to AI’s future as previously assumed.

China’s AI Independence – DeepSeek’s competitive AI development, despite export restrictions, highlights China’s growing ability to create powerful AI models without relying on U.S. technology, signalling a potential shift in the global AI balance.

Geopolitical Tensions – The U.S. is investigating DeepSeek’s supply chain, and lawmakers are pushing for stricter AI chip export regulations. This could lead to increased division in AI development between China and the West, amplifying geopolitical tensions.

DeepSeek’s rapid rise is forcing the AI industry to reconsider the costs, accessibility, and geopolitical dynamics of AI development.

Has The NVIDIA Bubble Popped?

The company most affected by DeepSeek’s rise is Nvidia, which has suffered substantial losses in market cap.

Key Impacts on Nvidia:

Weakened Market Position – DeepSeek’s success suggests that AI development might not be as dependent on Nvidia’s chips, undermining its pricing power and its influence over tech companies.

Shifting AI Investment Narratives – Companies like Google and Microsoft may reassess their AI spending, potentially reducing their investments in Nvidia GPUs and data centres, which could affect Nvidia’s long-term revenue.

Increased Competition – DeepSeek’s success opens the door for competitors like Broadcom and Huawei, highlighting a shift towards alternatives to Nvidia in AI hardware.

Despite these challenges, DeepSeek has cast doubt on Nvidia’s previous dominance, suggesting potential long-term shifts in the AI supply chain.

Would I Buy The NVIDIA Dip?

Despite the challenges posed by DeepSeek, there are reasons to remain optimistic about Nvidia’s future.

Nvidia’s continuous innovation, exemplified by the Blackwell architecture and Project Digits, shows the company’s ability to adapt to evolving AI demands. Analysts remain bullish on Nvidia’s growth, and the current market dip could present a buying opportunity, particularly at technical support levels like $116 or lower. For those with a long-term investment strategy, Nvidia’s strong market position in AI development and consistent growth projections make it a promising investment.

Losers And Winners Of DeepSeek

While Nvidia may be a potential loser, it could recover at the right price. Other companies and sectors will experience winners and losers as DeepSeek continues to disrupt the AI landscape.

Keep reading to find out the one stock I’ve bought after the DeepSeek Dip.

DeepSeek Losers

Companies Betting on AI Monopolies – Closed-source firms like OpenAI and Google may face challenges as cheaper, open-source alternatives to AI emerge, altering the competitive landscape.

White-Collar Jobs at Risk – As AI models like DeepSeek take over repetitive tasks, many white-collar roles, especially in fields like legal, accounting, and administration, could see reduced demand for human labor.

Companies Slow to Adapt – Businesses that fail to integrate AI into their operations risk falling behind. The rapid pace of AI innovation rewards those who embrace it and punishes those who don’t.

DeepSeek Winners:

Apple and Hardware Innovators – Apple stands to gain from AI decentralization, as its unified memory architecture allows for more efficient AI processing on local devices. This shift could boost Apple’s Mac and chip sales.

Open-Source AI and Small Innovators – The open-source AI movement is gaining momentum, with companies like Meta benefiting from increased adoption of open-source models. Startups and researchers now have access to powerful AI without relying on closed systems like OpenAI’s.

Energy and Compute Providers – As AI models grow more complex, demand for computing power and electricity will rise. Companies involved in semiconductor manufacturing, GPUs, and cloud computing, along with renewable energy sources like solar and nuclear power, stand to benefit from this increased demand.

DeepSeek’s emergence is reshaping the AI sector, with both opportunities and challenges emerging across various industries.

Nebius NBIS 0.00%↑ ; A Hidden AI Gem

The stock is up almost 10% since I posted about it on SA, and paid members got a gift link to see the full article.

Here’s the gist of it.

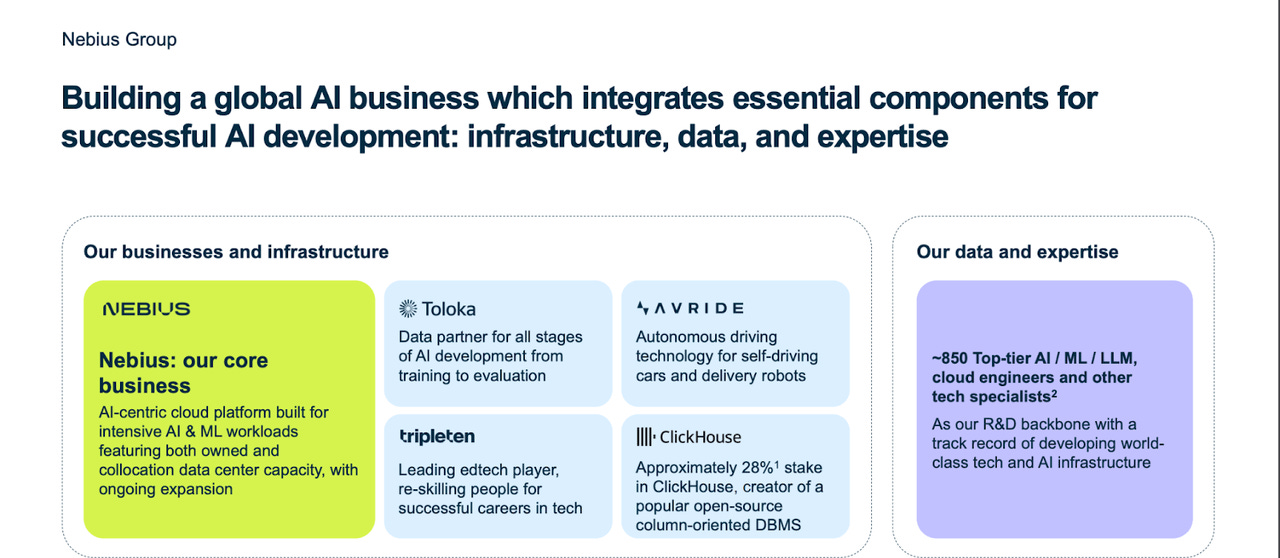

Nebius Group N.V. (NASDAQ:NBIS), a full-stack Cloud AI provider, presents a compelling investment opportunity, especially following a 40% drop in its stock price. Despite recent volatility, Nebius is poised to benefit significantly from the AI revolution, particularly as technologies like DeepSeek make AI more accessible.

Nebius offers a combination of data centers, custom hardware, and software solutions, alongside stakes in AI-related businesses like Avride and ClickHouse, further enhancing its value.

The company’s projected AI revenue growth, with a TAM of $260 billion by 2030, suggests strong potential. Nebius is undervalued compared to peers, with a possible 50% upside.

While risks such as regulatory hurdles and capital expenditures exist, the company’s strong financial position and growth prospects make it an attractive investment. At its current price of $30, Nebius could see significant price appreciation, potentially doubling by 2025.

This is the latest addition to my YOLO Portfolio, which grew 76% last year.

Final Thoughts + Discount

It’s a new world, both technologically and for markets. The across-the-board rally of 2024 will likely not repeat in 2025.

Tech stocks still have A LOT of returns to offer, but investors need to be more selective.

Specific stock ideas are exactly what you get when you sign up to the Pragmatic Investor.

You’ll gain access to:

My Long-term Stock Portfolios

My Swing Trades and Trendspider Algorithm

My recently developed Macro Matrix

If you made it this far, you’re a real one! Here’s a 30% discount to reward your perseverance.

Four letters: CUDA. Two decades of developer relationships don't evaporate overnight. The pie always grows bigger than anyone expects.