Trades

In the simplest of forms, there are two ways of investing.

Buying and holding for the long-term

Trading in and out of assets

For long-term trading, we have our End Of The World and YOLO Portfolios, you can read more about them here.

Portfolios

So you want to check out what I own? Great, let me show you. But first a quick rundown of how my 2 portfolios are structured.

But this section is devoted to our Trades, which can be divided into two types.

Stock Swing Trades

Macro Trades

Swing Trades

Swing Trades are positions on US-listed stocks. I use technical analysis, my market-beating algorithm and also some fundamentals to find good entry and exit points in single stocks.

You can learn more about what drives my trade decisions here.

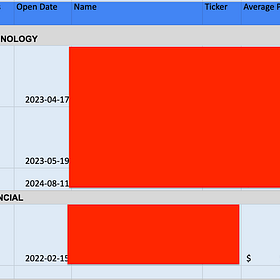

Our Swing Trades make up our Swing Portfolio, which subscribers gain access to.

I update this portfolio weekly and add new trades regularly.

The best thing is you can track all of the trades super easily on this Excel sheet.

Here you will find:

Open/Closed positions and orders

Entry levels, Stop, Losses and Take-Profit targets

A description of the trade set-up; The How and Why

A link to the most recent technical chart

The performance can then be tracked through Snowball Analytics.

Macro Trades

Our Macro Trades are quite different from our stock trades. While there may be some technical analysis used to find key levels, macro trades are guided by fundamentals.

We are looking at shifts in monetary and fiscal policy, dynamics in inflation, employment, interest rates and also geopolitical trends that we can take advantage of.

Want to learn more? Read the post below.

Our Macro trades are also tracked in an Excel sheet and through Snowball Analytics.