My Last Two YOLO Trades Crushed It (+25%)—Here’s What I’m Buying Next

I think this stokc could double from today's price by 2026

TL;DR

As you probably know, I often cover high-growth/return opportunities on this substack. The stocks I like,I add to my aptly named YOLO portfolio.

In the last two weeks, we’ve added two AI plays to the portfolio, and they are up 25% on aggregate.

Today, I’d like to quickly review the two stocks and the thought process that went into making these investment decisions.

Finally, we’ll cover in-depth my latest YOLO stock, which I told subscribers to add earlier in the week.

This is a stock with a lot of growth potential, market dominance and the “indirect” blessing of Bill Ackman.

Expect To Learn

Why I Added Tempus AI to the YOLO Portfolio

How I Found A Great Stock To Buy On The DeepSeek Dip

Why I Expect My Latest Stock Pick To Double In 2025

Please enjoy!

Tempus AI; All Hail Pelosi (+32%)

On January 27th I published this piece:

The same day I added shares of TEM to the YOLO portfolio. This recently IPO’d healthcare AI stock had flown under the radar, but that soon changed when Nancy Pelosi disclosed she had a long position in the stock.

Pelosi’s moves are highly followed given her incredible track record. I like to see what she does through the Pelosi tracker, a neat little tool on Trendspider which instantly alerts us once this information is available. Bear in mind that there’s quite a lag between when she makes a trade and when she discloses it.

The stock fits nicely into two of the things I like to look for when investing for outsized returns.

Recent IPO

Narrative Driven

With that said, I quickly bought the stock, alerted subscribers, and then followed up with some deeper research.

The two things that made me convinced this could be a good trade were.

Large TAM

Competitive Edge

I discussed this in-depth in the report. Ultimately though, this is what you need to look at with such young companies. Earnings and valuation are not necessarily great tools here, yet.

Nebius; AI Pick Of The Decade (+15.9%)

Then last week, we reported on Nebius, which got pummelled after the DeepSeek sell-off.

I actually found the stock with the help of a Seeking Alpha screener. As we can see, NBIS was ranked 7th out of its industry, with a strong Quant Rating and favourable metrics across the board.

In this case, following a little digging, it became apparent that the stock was undervalued after the sell-off.

In 2024, Corewave’s revenues was around $2 billion with a $23 billion valuation implying an 11.5x earnings ratio.

Nebius expects close to $1 billion in 2025, so if we apply an 11.5x ratio then we’re looking at a market cap of over $11 billion. The stock was trading at $8 mcap when I first wrote this and now it sits near $9 billion.

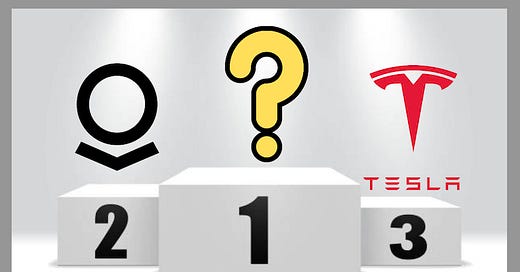

My Next Big Bet

So, we’ve added another stock to our YOLO portfolio this week.

This stock operates in a high-growth area outside of the US, just turned profitable, and also has an untapped potential financial segment that could explode in the next few years.

Plus, as we can see, this stock scores really highly in all the SA metrics. It’s favoured by analysts and has a strong quant score, as well as great scores in valuation, growth and profitability.

The stock ran up towards the end of 2023, but has been consolidating nicely in 2024, preparing a launchpad to get us back to new ATHs.

In celebration of our recent streak of success, here’s a 25% discount to the Pragmatic Investor.

A subscription gets you

In-depth stock reports

Live trade and portfolio updates

Market beating Trendspider algorithm

Full Macro Reports

And I’ll also be starting livestreaming once we cross the 50-subscriber mark!

Also, prices will be increasing on February 28th, so this is your last chance to lock in this extra low price!

Keep reading with a 7-day free trial

Subscribe to The Pragmatic Investor to keep reading this post and get 7 days of free access to the full post archives.